AI and Predictive Modeling for Property Values

Introduction to AI-Powered Property Valuation

Understanding the Fundamentals of AI in Property Valuation

Artificial intelligence (AI) is rapidly transforming various industries, and property valuation is no exception. AI-powered tools leverage complex algorithms and vast datasets to analyze numerous factors influencing property values, such as location, size, condition, market trends, and even neighborhood demographics. This allows for more accurate and efficient valuations compared to traditional methods, which often rely on subjective assessments and limited data.

The core principle behind AI in this context is predictive modeling. Algorithms learn from historical data to identify patterns and relationships between different property characteristics and their corresponding market values. This learning process allows the AI to predict future values with increasing accuracy, providing valuable insights for investors, homeowners, and real estate professionals.

Data Sources Fueling AI Valuation Models

Accurate and comprehensive data is the lifeblood of any AI-powered property valuation system. These systems utilize a multitude of data sources, including public records (property assessments, sales history), market listings (recent transactions, asking prices), and even external factors like crime rates, school ratings, and local economic indicators. The sheer volume and complexity of this data necessitate sophisticated data processing and integration techniques to derive meaningful insights.

Gathering, cleaning, and preprocessing this data is a critical step. Inconsistencies, errors, and missing values must be addressed to ensure the integrity and reliability of the AI models. This often involves sophisticated data engineering and quality control measures.

The Role of Machine Learning in AI-Driven Valuation

Machine learning (ML), a subset of AI, plays a crucial role in developing accurate and reliable property valuation models. ML algorithms, such as regression, decision trees, and neural networks, learn from the input data to identify patterns and relationships, ultimately predicting future property values. The iterative nature of ML allows the models to continuously improve their accuracy as they are exposed to new data and market trends.

Improving Accuracy and Efficiency through AI

AI-powered valuation tools significantly improve the accuracy and efficiency of the property valuation process. By automating the analysis of vast datasets and identifying intricate relationships, AI can quickly assess properties, reducing the time and resources required for traditional methods. This also allows for more consistent and objective valuations, minimizing subjectivity and potential biases.

This enhanced efficiency translates to faster turnaround times, enabling faster decision-making for investors and real estate professionals. Real-time data updates and continuous learning further enhance the responsiveness and accuracy of the valuation process.

Challenges and Considerations in AI-Powered Valuation

While AI offers significant advantages, several challenges remain. The reliability of AI-driven valuations depends heavily on the quality and completeness of the data used to train the models. Data biases or limitations can skew the results, potentially leading to inaccurate or unfair valuations. Ensuring data diversity and addressing potential biases is crucial for equitable and reliable outcomes.

Furthermore, the complexity of AI models can make it difficult to understand how they arrive at their predictions. This black box nature raises concerns about transparency and trust. Efforts to improve the explainability of AI models are crucial for building confidence in the valuation process.

The Future of AI in Property Valuation

The integration of AI in property valuation is poised for significant growth in the coming years. Advancements in machine learning, particularly in areas like deep learning, will enhance the sophistication and accuracy of valuation models. Furthermore, the increasing availability of real-time data and the growing interconnectedness of property markets will further fuel the development of more responsive and adaptive valuation tools.

Expect to see AI playing an increasingly important role in various aspects of the real estate industry, from mortgage lending and investment decisions to property management and market analysis.

Machine Learning Algorithms for Predictive Modeling

Supervised Learning Algorithms

Supervised learning algorithms are a crucial part of predictive modeling, where the algorithm learns from a labeled dataset. This means the data includes both the input features and the corresponding output variable, allowing the algorithm to establish a relationship between them. Examples include linear regression, logistic regression, support vector machines (SVMs), and decision trees. Each algorithm has its strengths and weaknesses, and the choice depends on the specific characteristics of the dataset and the desired outcome. Understanding the underlying assumptions and limitations of each algorithm is essential for building reliable predictive models.

Linear regression, for instance, assumes a linear relationship between the input features and the output variable, making it suitable for tasks where a linear trend is evident. Conversely, decision trees can capture complex non-linear relationships, but may be prone to overfitting if not carefully pruned or regularized.

Unsupervised Learning Algorithms

Unsupervised learning algorithms work with unlabeled data, focusing on discovering hidden patterns and structures within the dataset. These algorithms are invaluable for tasks like clustering and dimensionality reduction. Popular examples include k-means clustering, hierarchical clustering, and principal component analysis (PCA). K-means clustering groups data points into clusters based on their similarity, while PCA reduces the number of variables in a dataset while retaining most of the variance.

These algorithms are often used as preprocessing steps for supervised learning tasks, or to gain insights into the underlying structure of the data before applying more sophisticated models.

Reinforcement Learning Algorithms

Reinforcement learning (RL) algorithms are distinct from supervised and unsupervised learning. In RL, an agent learns to make decisions in an environment by interacting with it and receiving feedback in the form of rewards or penalties. This feedback helps the agent adjust its strategy over time to maximize cumulative rewards. Examples of RL algorithms include Q-learning and deep Q-networks (DQNs).

RL algorithms are particularly well-suited for tasks involving sequential decision-making, such as robotics control, game playing, and resource management. The agent learns through trial and error, adapting its actions based on the outcomes of its previous choices.

Model Evaluation and Selection

Evaluating the performance of a predictive model is critical for ensuring its reliability and accuracy. Various metrics, such as accuracy, precision, recall, F1-score, and area under the ROC curve (AUC), are used to assess the model's ability to correctly predict outcomes. Choosing the right evaluation metric depends on the specific application and the relative importance of different types of errors.

Techniques like cross-validation are essential for evaluating model performance on unseen data and mitigating the risk of overfitting. Careful consideration of the trade-offs between model complexity and performance is crucial for selecting the most suitable model for a given task.

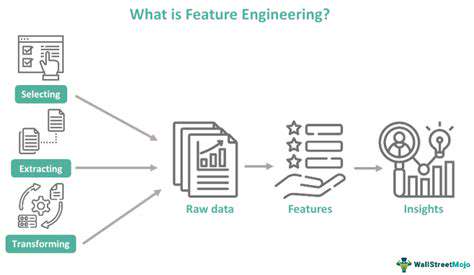

Feature Engineering and Selection

The quality of the data significantly impacts the performance of predictive models. Feature engineering involves transforming raw data into more informative features that can improve model accuracy. This might include creating new features, combining existing ones, or handling missing values effectively. Feature selection focuses on identifying the most relevant features for the model.

Effective feature engineering and selection can enhance model performance by reducing noise, improving interpretability, and avoiding overfitting. Careful consideration of the characteristics of the data and the specific problem being addressed is crucial for choosing appropriate feature engineering and selection techniques.

Model Deployment and Maintenance

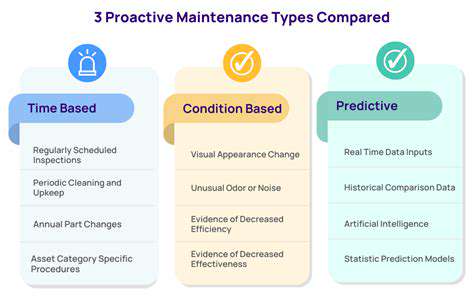

Deploying a predictive model involves integrating it into a system where it can be used to make predictions on new data. This often involves integrating the model with other systems, such as databases or APIs. Continuous monitoring and maintenance of the model is essential to ensure its continued accuracy and relevance.

As new data becomes available, the model may need to be retrained or adjusted to adapt to changing trends or patterns. Effective deployment strategies consider factors like scalability, maintainability, and security.

The Impact of AI on Real Estate Agents and Investors

The Rise of AI-Powered Property Valuation

Artificial intelligence is rapidly transforming the real estate market, particularly in property valuation. AI algorithms can analyze vast amounts of data, including comparable sales, property characteristics, and market trends, to generate highly accurate valuations in a fraction of the time it takes traditional methods. This increased speed and efficiency translates into significant benefits for both buyers and sellers. The ability to assess property worth objectively and quickly reduces uncertainty and promotes informed decision-making.

This automated valuation process reduces the margin for error inherent in human judgment, leading to more precise estimations. By considering a wider range of factors and applying sophisticated statistical models, AI can identify patterns and correlations that might otherwise be missed, ultimately leading to a more accurate reflection of market value.

AI-Driven Marketing Strategies

AI is revolutionizing marketing strategies in real estate by enabling highly targeted campaigns. By analyzing consumer preferences, demographics, and online behavior, AI tools can identify potential buyers and tailor marketing messages accordingly. This personalized approach significantly increases the effectiveness of advertising and leads to a higher conversion rate.

Real estate agents can leverage AI-powered tools to create more compelling marketing materials, from generating customized property descriptions to creating virtual tours and 3D models. These interactive experiences significantly enhance the buyer's engagement and understanding of the property, ultimately leading to a greater likelihood of a successful sale.

Optimizing Real Estate Transactions

AI is streamlining the entire transaction process, from initial property searches to final closing. Automated systems can handle tasks such as scheduling viewings, managing contracts, and processing paperwork, significantly reducing administrative burdens on agents and clients alike. This efficiency translates into faster transaction times and a smoother overall experience.

By automating mundane tasks, AI frees up real estate professionals to focus on higher-value activities, such as building client relationships and negotiating deals. This improved workflow leads to better service and a more positive experience for all parties involved in a real estate transaction.

Predictive Analytics in Real Estate

AI's predictive capabilities are transforming real estate investment strategies. By analyzing historical data and current market trends, AI algorithms can forecast future property values and market fluctuations, providing valuable insights for investors. These predictions can help investors make informed decisions about property purchases, rental strategies, and long-term investment plans.

AI-driven predictions enable investors to identify emerging markets and potentially lucrative opportunities. This forward-looking approach allows them to position themselves strategically and capitalize on growth potential, ultimately maximizing returns.

Enhancement of Customer Experience

AI-powered chatbots and virtual assistants are enhancing customer interactions in the real estate industry. These tools can answer frequently asked questions, schedule appointments, and provide instant support, improving customer satisfaction and reducing wait times. This 24/7 availability significantly enhances the overall customer experience.

Through personalized recommendations and proactive support, AI-powered systems create a more engaging and efficient customer journey. This positive interaction fosters trust and loyalty, ultimately strengthening the relationship between real estate agents and their clients.

Addressing Challenges and Ethical Considerations

While AI presents exciting opportunities, it's crucial to acknowledge the challenges and ethical considerations associated with its implementation in real estate. Ensuring data accuracy, maintaining transparency in algorithms, and addressing potential biases in AI systems are critical to ensuring fair and equitable outcomes. The responsible and ethical use of AI is paramount to maintaining consumer trust.

Careful consideration must be given to the potential displacement of human roles and the need for continuous monitoring and adjustments to AI systems to maintain fairness and objectivity in property valuation and transactions. The industry must navigate these complexities to fully leverage the benefits of AI while mitigating potential risks.

Future Trends and Challenges in AI-Driven Property Valuation

Emerging AI Valuation Models

The field of AI-driven property valuation is rapidly evolving, with new models constantly being developed and refined. These models are leveraging increasingly sophisticated algorithms and vast datasets to predict property values with greater accuracy. Machine learning algorithms, particularly deep learning architectures, are showing promise in identifying complex patterns and relationships within property data that traditional methods might miss, leading to more nuanced and potentially more accurate valuations. Furthermore, the integration of real-time data streams, such as market trends and economic indicators, further enhances the predictive power of these models, making them more responsive to changes in the market.

One significant trend is the use of generative AI models. These models can synthesize realistic scenarios for property values under different market conditions, allowing for more comprehensive risk assessments and scenario planning. This capability is particularly valuable for investors and lenders who need to understand the potential range of outcomes for a given property investment. The ability to create synthetic data sets for training and testing AI models is also becoming more accessible, which can help address the limitations of limited historical data in certain geographic areas or for specific property types.

Challenges and Ethical Considerations

Despite the advancements, several challenges remain in the implementation of AI-driven property valuation. One significant hurdle is the availability and quality of data. AI models are only as good as the data they are trained on. Inaccurate, incomplete, or biased data can lead to inaccurate or unfair valuations. Ensuring data quality, standardization, and accessibility across different property types and geographic locations is crucial for the responsible development and deployment of these models.

Another challenge lies in the potential for algorithmic bias. AI models can inherit and amplify biases present in the training data, potentially leading to discriminatory valuations. Careful consideration and rigorous testing are necessary to identify and mitigate these biases to ensure fair and equitable valuations for all property owners. This necessitates the development of robust validation and testing procedures to identify and address potential biases in the models.

Ethical considerations surrounding the use of AI in property valuation are also paramount. Transparency in how AI models arrive at their valuations is critical to build trust and ensure accountability. The potential for misuse of AI-powered valuation tools, such as manipulating market prices or creating false valuations for fraudulent purposes, also requires careful consideration and regulatory frameworks. Maintaining a balance between innovation and responsible application of AI in property valuation is essential for ensuring fairness and trust.

Finally, the integration of AI into existing valuation processes and workflows must be carefully managed. Resistance to change from established professionals and the need for robust training and support for users are significant challenges. Addressing these issues is essential for the successful and widespread adoption of AI-powered valuation tools.

Read more about AI and Predictive Modeling for Property Values

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

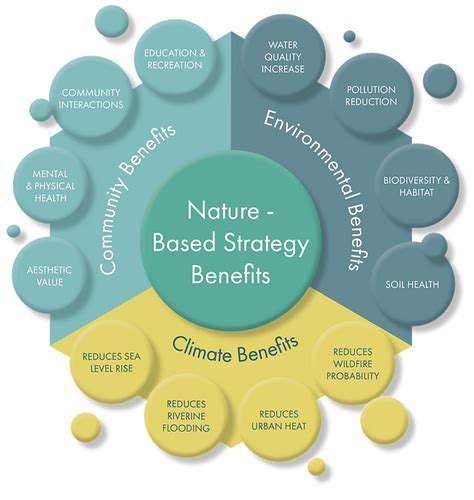

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

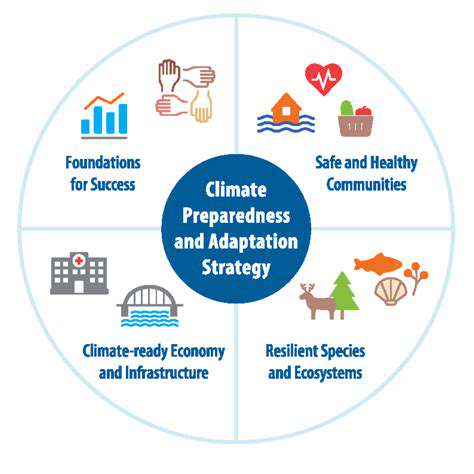

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing