Sustainable Real Estate: The Developer's Handbook

Economic Viability and Sustainability Strategies

Economic Viability

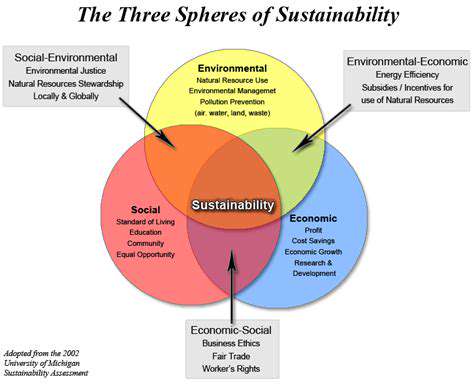

Financial sustainability requires balancing multiple economic forces. The most successful projects treat profitability not as an end goal, but as fuel for ongoing impact. What distinguishes viable ventures is their ability to convert environmental and social value into measurable financial returns through mechanisms like energy savings, health benefits, and community goodwill.

Market analysis should extend beyond conventional metrics to identify emerging value drivers. The growing premium placed on wellness-oriented spaces and climate-resilient properties illustrates how demographic shifts create new economic opportunities for prepared developers.

Sustainability Strategies

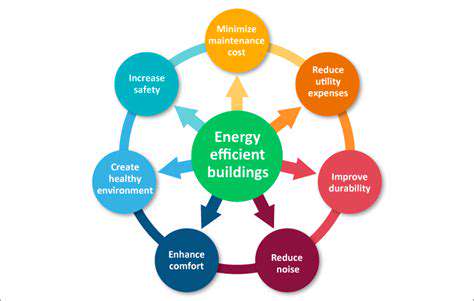

Green building practices have evolved from cost centers to value generators. Buildings with robust sustainability features now command higher occupancy rates and rental premiums, while also benefiting from operational efficiencies. The key lies in selecting interventions that align with both ecological priorities and tenant expectations.

Market Analysis and Trends

Discerning investors track leading indicators like corporate sustainability commitments and urban policy shifts. When major employers adopt clean energy mandates or cities implement carbon pricing, they create cascading effects across real estate markets. The ability to anticipate these transitions separates reactive players from market leaders.

Financial Projections and Modeling

Advanced modeling now incorporates climate scenarios and regulatory timelines. Forward-looking pro formas might simulate carbon tax impacts or calculate the depreciation schedules for different sustainability investments, providing more nuanced decision frameworks.

Risk Assessment and Mitigation

Contemporary risk matrices must account for climate volatility and policy uncertainty. Portfolios that systematically assess physical climate risks and transition exposures demonstrate greater long-term stability. This might involve stress testing assets against various warming scenarios or analyzing regulatory proposals for potential impacts.

Resource Allocation and Management

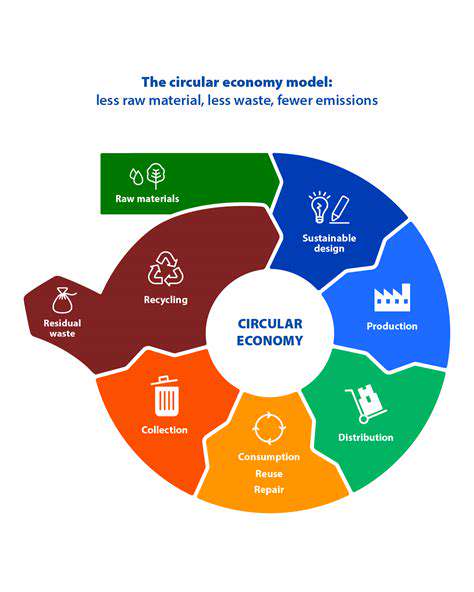

The circular economy paradigm is transforming resource strategies. From modular construction techniques that enable material reuse to greywater systems that conserve potable water, innovative resource management creates compounding value while reducing environmental footprints.

Navigating Regulations and Certifications for Sustainable Projects

Understanding the Landscape of Sustainable Regulations

The regulatory environment resembles a complex ecosystem where local ordinances interact with international frameworks. Savvy developers maintain dynamic compliance maps that track everything from evolving energy codes to emerging biodiversity protections. In coastal regions, for instance, updated floodplain management regulations might dramatically alter development possibilities.

Importance of Certifications for Credibility and Market Access

Third-party validations serve multiple functions—they verify performance, communicate values, and often unlock financial incentives. Certain certifications now influence everything from insurance premiums to corporate tenant selection criteria, making them essential tools for competitive positioning.

Tailoring Certification Strategies to Specific Project Needs

Certification selection requires strategic alignment with project goals. A multifamily development targeting health-conscious renters might pursue WELL certification, while a commercial tower could prioritize energy-focused credentials. The smartest approaches layer complementary certifications to address different stakeholder priorities.

Ensuring Ongoing Compliance and Monitoring

Sustainability isn't a one-time achievement but an ongoing practice. Digital monitoring platforms that track energy use, water consumption, and waste generation help maintain certification standards while identifying optimization opportunities. These systems turn compliance from a bureaucratic requirement into a value-creating process.

Read more about Sustainable Real Estate: The Developer's Handbook

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing