AI in Real Estate Market Prediction Models

Introduction to AI in Real Estate Forecasting

Understanding the Potential of AI

Artificial intelligence (AI) is rapidly transforming various industries, and real estate forecasting is no exception. AI algorithms, particularly machine learning models, can analyze vast amounts of data to identify patterns and trends that might be missed by human analysts. This ability to process and interpret complex information allows AI to predict future market movements with greater accuracy and efficiency than traditional methods, potentially leading to improved investment decisions and more informed property valuations.

The potential benefits of AI in real estate forecasting extend beyond just predicting market trends. AI can also be used to personalize property recommendations, optimize pricing strategies, and even streamline the entire property management process. By automating tasks and providing insightful data analysis, AI can help real estate professionals make better-informed decisions and ultimately contribute to a more efficient and profitable market.

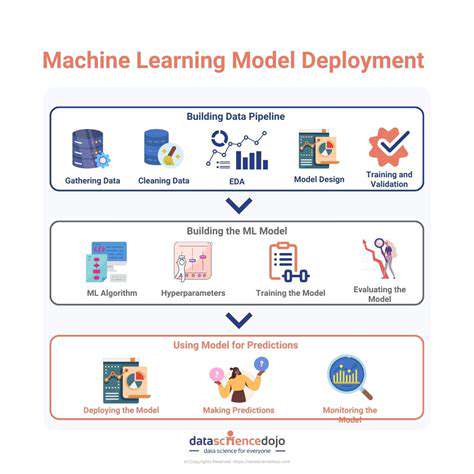

AI-Driven Forecasting Models

Numerous AI-driven forecasting models are emerging in the real estate sector. These models leverage various data sources, including historical sales data, market trends, economic indicators, and even social media sentiment. By combining these diverse data points, AI models can create sophisticated predictive models, identifying factors that influence property values and market fluctuations. This data-driven approach gives real estate professionals a more detailed understanding of the market, enabling them to make more accurate forecasts and anticipate potential challenges.

One key aspect of AI-driven forecasting models is their ability to adapt and learn from new data. As new information becomes available, these models can continuously refine their predictions, ensuring that their forecasts remain relevant and accurate in a dynamic market. This iterative learning process is crucial for maintaining the reliability of AI-based forecasts and keeping pace with the ever-changing real estate landscape. This adaptability allows for a more nuanced and responsive approach to market prediction, ultimately leading to better decision-making.

Furthermore, these AI models can assess various risk factors and potential market fluctuations. This comprehensive analysis allows for proactive measures and informed strategies, reducing vulnerabilities and enhancing decision-making processes within the real estate sector. The result is a more resilient and responsive real estate market, better equipped to handle unexpected events and maintain stability.

The application of AI in real estate forecasting is a relatively new field, but it promises to revolutionize the way we understand and predict real estate markets. AI models are becoming increasingly sophisticated, enabling more accurate and nuanced forecasts than ever before.

With continuous advancements in AI technology, we can expect even more sophisticated and effective models to emerge in the future, further enhancing the accuracy and reliability of real estate forecasting.

Evaluating and Improving AI Model Performance

Understanding AI Model Evaluation Metrics

Evaluating the performance of AI models is crucial for ensuring their effectiveness in real estate market prediction. A variety of metrics are used to assess different aspects of model accuracy and reliability. These metrics, such as Mean Squared Error (MSE), Root Mean Squared Error (RMSE), and R-squared, provide quantitative insights into how well the model predicts housing prices, rental yields, or other relevant real estate indicators. Understanding these metrics allows stakeholders to gauge the model's predictive power and identify areas needing improvement. Furthermore, comparing different models using these metrics facilitates informed decisions on model selection for practical application.

Beyond simple accuracy measures, consideration should be given to the specific context of real estate. For instance, a model might be highly accurate in predicting average prices but less accurate in predicting price fluctuations. This aspect requires a nuanced understanding of the specific real estate market being analyzed and the intended use of the model's predictions. A deeper analysis may include metrics such as precision and recall, which are particularly valuable in identifying potential misclassifications or missed opportunities. Understanding the strengths and weaknesses of various metrics is essential for creating a comprehensive evaluation strategy.

Addressing Model Biases and Limitations

AI models are trained on data, and if that data reflects existing societal biases, the model will likely perpetuate those biases. In the real estate market, biases in datasets can lead to unfair or inaccurate predictions for specific demographic groups or geographic locations. Identifying and mitigating these biases is critical to ensure fair and equitable outcomes in real estate transactions. This requires careful scrutiny of the training data, the identification of potential problematic correlations, and the implementation of strategies to address these biases before deploying the model in a real-world setting. Careful attention to data quality, diversity, and representativeness is essential for building trustworthy and unbiased AI models.

Another critical aspect of model evaluation is considering the limitations of the model itself. No AI model is perfect. There are inherent constraints based on the data used, the algorithms employed, and the complexity of the real estate market. A thorough understanding of these limitations is paramount. This may include acknowledging the model's inability to account for unforeseen market shocks or regulatory changes. Recognizing these limitations helps establish realistic expectations for the model's performance and its potential impact on real estate decision-making.

Improving Model Performance Through Fine-tuning and Refinement

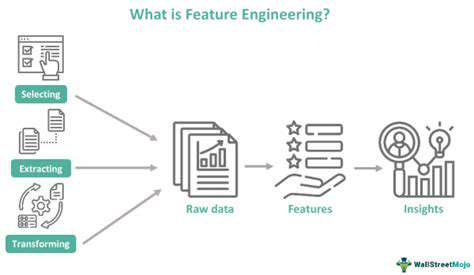

Improving AI model performance often involves iterative refinement and fine-tuning. This process can include techniques like feature engineering, which involves creating new variables from existing ones to capture more complex relationships within the data. This approach can enhance the model's ability to predict market trends and fluctuations effectively. Furthermore, utilizing various machine learning algorithms and exploring different model architectures can lead to improved predictive accuracy. Testing different algorithms and architectures allows for a comparison of results and the selection of the model that best suits the specific characteristics of the real estate market.

Regular monitoring and retraining of the model are crucial to maintaining its accuracy and relevance over time. As real estate markets evolve, the model needs to adapt to new trends and patterns. This can be achieved by continually updating the training data with the latest available information. This ensures the model stays current with evolving market dynamics, resulting in more reliable and effective predictions for future market conditions. This proactive approach is essential for long-term success in real estate market prediction using AI.

Furthermore, incorporating external factors, such as economic indicators, regulatory changes, and demographic shifts, can significantly enhance the model's predictive capabilities. This broader perspective allows for a more holistic understanding of the market and yields more accurate forecasts. The inclusion of these factors in the model training process results in a deeper understanding of real estate market dynamics and can lead to more robust predictions.

Regularly evaluating the model's performance against new data is essential to identify and address any emerging weaknesses. This iterative process of refinement and improvement ensures the model remains aligned with the evolving market conditions and maintains its predictive accuracy. Utilizing techniques like cross-validation and backtesting allows for a rigorous assessment of the model's stability and reliability in real-world scenarios.

The Future of AI in Real Estate Forecasting

AI-Powered Property Valuation

AI algorithms are revolutionizing the way property values are assessed. By analyzing vast datasets including comparable sales, market trends, and property characteristics, AI can provide more accurate and timely valuations than traditional methods. This increased precision is crucial for both buyers and sellers, as it ensures fair market pricing and facilitates smoother transactions. This leads to improved efficiency and reduced reliance on subjective estimations.

The use of machine learning models in property valuation allows for the consideration of complex factors, such as neighborhood demographics and local economic indicators, that might be overlooked by human appraisers. This comprehensive approach to valuation ultimately leads to a more sophisticated and reliable understanding of property worth.

Predictive Maintenance and Building Optimization

AI can significantly improve building management by predicting potential maintenance needs. By analyzing sensor data from various building systems, AI can identify patterns and anomalies that indicate impending equipment failures. This proactive approach allows for preventative maintenance, minimizing downtime and costly repairs.

Moreover, AI can optimize building energy consumption by adjusting HVAC systems and lighting based on real-time data and occupancy patterns. This not only reduces energy costs but also contributes to a more sustainable and environmentally friendly approach to building management.

Automated Property Management

AI-powered chatbots and virtual assistants are streamlining property management tasks. These tools can handle routine inquiries, schedule maintenance requests, and even collect rent payments, freeing up property managers' time to focus on more complex issues. This automation significantly increases efficiency and reduces administrative overhead.

Enhanced Customer Experience

AI-driven tools can personalize the real estate experience for both buyers and sellers. By analyzing user preferences and past interactions, AI can tailor property listings and recommendations to specific needs. This personalized approach can lead to a more satisfying and efficient home-buying or selling process.

AI-powered virtual tours and 3D renderings provide prospective buyers with immersive experiences, enabling them to visualize themselves in the property even before visiting in person. This technology significantly enhances the overall customer experience.

Real Estate Fraud Detection

AI can identify fraudulent activities in real estate transactions, such as forged documents or inflated property values. By analyzing large datasets of transaction records and identifying anomalies, AI algorithms can flag suspicious patterns that might be missed by human review. This proactive fraud detection system protects both buyers and sellers from potentially harmful transactions.

Personalized Financing and Investment Advice

AI can assist individuals in navigating the complexities of real estate financing and investment. By analyzing individual financial profiles and market trends, AI can provide personalized recommendations for mortgage options, investment strategies, and risk assessments. This personalized approach empowers individuals to make informed decisions in the real estate market.

AI can also analyze market data to identify profitable investment opportunities and predict future trends in a particular area. This forward-thinking approach allows investors to make more strategic decisions and potentially maximize returns.

Read more about AI in Real Estate Market Prediction Models

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing