AI in Real Estate: Personalized Investment Portfolios

Understanding Your Financial Goals

A crucial first step in crafting a personalized investment strategy is a thorough Understanding of your financial goals. This involves more than just accumulating wealth; it encompasses your short-term objectives, like saving for a down payment on a house, and your long-term aspirations, such as retirement planning. Clearly defining these goals provides a roadmap for your investments, ensuring they align with your desired outcomes. Understanding your risk tolerance is equally important. Different financial goals and timelines may require different levels of risk. A well-defined investment strategy will take into account your comfort level with potential market fluctuations.

Consider the time horizon for each goal. A longer time horizon, like retirement savings, generally allows for a more aggressive investment approach, potentially seeking higher returns. Conversely, a shorter time horizon, such as saving for a down payment, might necessitate a more conservative strategy to minimize risk. Properly assessing the time frame for your goals is key to developing a personalized investment plan that effectively manages risk and maximizes potential returns within your comfort zone.

Assessing Your Current Financial Situation

A comprehensive investment strategy requires a realistic assessment of your current financial situation. This includes evaluating your income, expenses, debts, and existing investments. Detailed records are essential for a thorough understanding of your current financial standing and how your investments can contribute to your goals. Knowing your current financial position will help you strategize effectively and avoid making unnecessary mistakes. An accurate assessment is vital to developing a personalized investment plan that is tailored to your unique financial profile.

Analyzing your debts is critical. High-interest debts, such as credit card debt, can significantly impact your investment returns. Addressing these debts early on can free up more resources for investment, potentially accelerating your progress towards your financial goals. Prioritizing debt reduction alongside investment planning is a vital part of a successful financial strategy.

Defining Your Risk Tolerance

Understanding your risk tolerance is fundamental to developing a successful investment plan. Risk tolerance refers to your willingness to accept potential losses in exchange for the possibility of higher returns. This factor is highly personal and dependent on your individual circumstances. Factors such as age, financial stability, and personal values all play a role in determining your comfort level with investment risk. A realistic assessment of your risk tolerance is paramount for creating an investment strategy that aligns with your individual goals and comfort level.

It's important to remember that risk tolerance isn't static. It can change over time as your financial situation evolves. Regularly reevaluating your risk tolerance is crucial to maintaining a personalized investment strategy that remains effective and aligned with your evolving needs and goals. Reviewing your tolerance periodically is crucial for maintaining a successful and adaptable investment strategy.

Selecting Appropriate Investment Vehicles

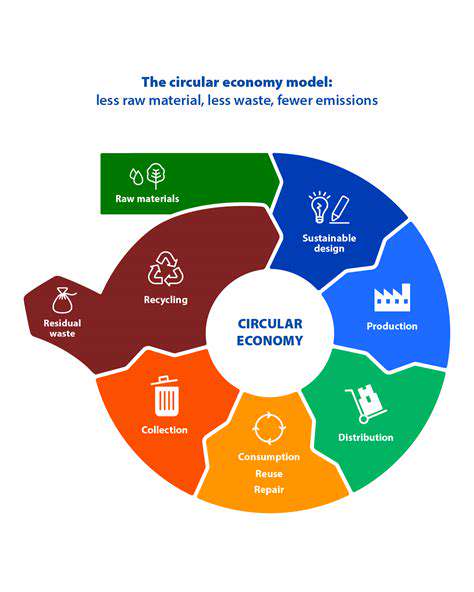

After carefully considering your goals, financial situation, and risk tolerance, you can begin to select appropriate investment vehicles. This process involves researching various options, such as stocks, bonds, mutual funds, and real estate, and understanding their potential risks and rewards. Thorough research and understanding the characteristics of each investment vehicle are critical to making informed decisions. Diversifying your investments across different asset classes is often recommended to mitigate risk and potentially enhance returns.

Consider consulting with a qualified financial advisor to gain insights and guidance on selecting the most suitable investment vehicles for your specific needs. A financial advisor can offer personalized recommendations based on your individual circumstances and help you navigate the complexities of the investment world. Professional guidance can significantly enhance your investment decisions and help you achieve your financial goals.

Cognitive processes are the mental actions or operations that involve acquiring, processing, storing, and retrieving information. These processes are fundamental to human behavior and include a wide range of activities, from basic perception and attention to complex problem-solving and decision-making. Understanding these processes is crucial for comprehending how individuals interact with their environment and make sense of the world around them. From simple sensory input to intricate reasoning, cognitive processes are the driving force behind our thoughts, feelings, and actions.

The Future of Real Estate Investment: AI-Driven Expertise

Investment Strategies for the Next Decade

The real estate market is constantly evolving, and staying ahead of the curve is crucial for successful investment. Understanding emerging trends and adapting investment strategies accordingly will be vital for maximizing returns and mitigating risks. This includes considering factors like population shifts, technological advancements, and changing consumer preferences.

Analyzing market data and identifying promising areas for growth will be paramount. Predicting future demand and supply dynamics will help investors make informed decisions about where to allocate their capital. Developing a nuanced understanding of local economies and demographics will also be essential.

The Role of Technology in Real Estate

Technology is rapidly transforming the real estate industry, impacting everything from property management to sales and marketing. The use of AI, machine learning, and data analytics is revolutionizing the way properties are valued and marketed, potentially increasing efficiency and transparency. This automation and data-driven approach will likely lead to more precise market analysis and potentially more accessible investment opportunities.

Virtual tours and online platforms are changing how buyers interact with properties. This shift towards digital engagement presents both opportunities and challenges for investors, requiring adaptation and possibly new forms of engagement strategies.

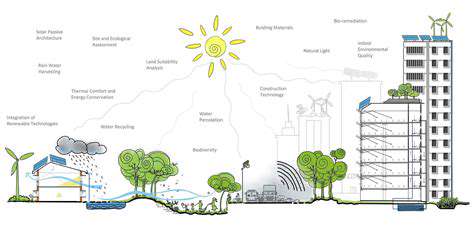

Sustainable and Green Building Practices

Environmental consciousness is impacting real estate investment decisions. Investors are increasingly seeking properties that incorporate sustainable and green building practices. This includes focusing on energy efficiency, reducing environmental impact, and utilizing renewable resources.

Properties that demonstrate a commitment to sustainability are likely to attract higher demand and potentially higher valuations in the future. This trend signifies a growing societal focus on environmentally responsible practices within the real estate sector.

The Impact of Demographic Shifts

Population shifts and changing demographics will influence real estate investment opportunities. Understanding these shifts and anticipating future needs will be critical for long-term success. Factors such as migration patterns, aging populations, and changing family structures must be considered when assessing investment potential.

Investing in areas experiencing population growth or specific demographic needs may prove lucrative. This includes considering potential demand for senior housing, multi-generational living spaces, or family-friendly communities.

Financing and Investment Access

The availability and cost of financing will significantly impact investment decisions. Keeping an eye on evolving interest rates and loan programs will be essential for navigating the market effectively. Investors should also consider the potential impact of government regulations and incentives on real estate investments.

Exploring alternative funding sources, such as crowdfunding platforms or private investors, could provide additional avenues for capital acquisition. This diversification in financing options may be crucial in certain market conditions.

Global Real Estate Trends

The global real estate market is becoming increasingly interconnected, creating opportunities and challenges for international investors. Understanding global trends and international regulations is crucial. This includes examining international investment opportunities, considering currency fluctuations, and navigating cross-border transactions.

Capitalizing on global trends and adapting investment strategies for a global market will be key for long-term success. This involves a sophisticated understanding of international market dynamics and a willingness to adapt to evolving regulations and market forces.

Read more about AI in Real Estate: Personalized Investment Portfolios

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing