Real Estate and Climate Change: A Global Perspective

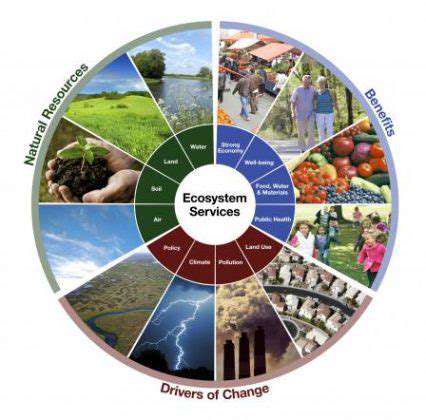

The Impact of Climate Change on Real Estate Globally

Rising Sea Levels and Coastal Erosion

Coastal properties face significant threats from rising sea levels and increased coastal erosion. This leads to property devaluation, potential inundation, and increased insurance costs. The long-term implications for coastal communities and the real estate market are substantial, requiring proactive measures like coastal defenses and retreat strategies. Communities need to carefully assess the vulnerability of their coastal areas and develop comprehensive adaptation plans.

The rising sea levels are not only eroding shorelines but also increasing the risk of saltwater intrusion into freshwater aquifers, further impacting the value and usability of land. This necessitates a multi-faceted approach to mitigate the effects of rising sea levels and protect valuable real estate investments in vulnerable coastal regions.

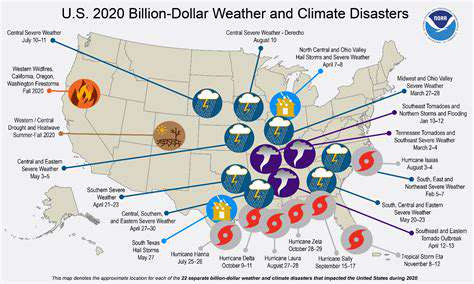

Extreme Weather Events and Property Damage

More frequent and intense hurricanes, floods, wildfires, and droughts are causing substantial property damage, leading to costly repairs and insurance claims. These events are disrupting real estate markets, impacting construction, and leading to increased insurance premiums, making certain areas less attractive for investment or occupancy. The effects on property values and the insurance industry are profound.

The unpredictability and intensity of extreme weather events are pushing real estate professionals and policymakers to consider long-term adaptation strategies. Understanding and addressing the heightened risks are critical for the sustainability of the real estate sector in vulnerable regions.

Changes in Temperature and Energy Efficiency

Rising temperatures are impacting energy consumption in buildings, leading to higher utility bills for homeowners and businesses. This necessitates the need for energy-efficient designs and materials in new construction and renovations. The shift towards sustainable practices will influence property values and demand for green building technologies. The demand for environmentally conscious construction practices is steadily increasing, and this trend will shape future real estate development.

Climate change's impact on temperatures also influences the suitability of certain regions for habitation. Areas experiencing extreme heat waves or prolonged droughts might become less desirable, leading to shifts in population distribution and impacting real estate markets in those areas. Understanding the long-term impacts of rising temperatures on housing is crucial for future planning.

Shifting Agricultural Lands and Food Security

Changes in rainfall patterns and agricultural yields are impacting the viability of agricultural land. This has implications for land values, food security, and the long-term sustainability of rural economies. Real estate markets in agricultural regions will be affected by changes in land productivity and demand for alternative uses of the land. These changes will have a significant knock-on effect on the entire real estate sector.

Water Scarcity and Increased Demand for Resources

Water scarcity is becoming a critical issue in many regions, affecting property values and land use. Areas with dwindling water resources will see decreased demand and potentially lower property values. Water scarcity also necessitates more efficient water-management strategies in construction and landscaping. This is a significant challenge for real estate professionals and communities to address in the face of climate change.

Impacts on Construction Materials and Processes

The availability and cost of construction materials, such as timber and concrete, are susceptible to climate change impacts. Supply chain disruptions, material shortages, and increased costs will impact construction projects. The sustainability of construction materials and building practices will become more critical. Real estate developers and builders must adapt to these changes to ensure the long-term viability of their projects and the communities they serve.

Insurance and Financial Implications

Climate change is significantly impacting insurance costs and availability. Increased risks from extreme weather events are driving up premiums, creating barriers to purchasing property insurance, and affecting the financial stability of insurance companies. Understanding and managing these risks is crucial for individuals, businesses, and financial institutions. Addressing the financial implications of climate change on the real estate sector is critical for sustainable growth and resilience.

Sea-Level Rise and Coastal Property Values

The Impact of Rising Tides

Sea-level rise, a direct consequence of climate change, poses a significant threat to coastal property values. As the ocean encroaches on land, properties located in vulnerable coastal areas face increasing risks of erosion, flooding, and saltwater intrusion. This gradual but relentless shift in the shoreline can lead to diminished property values, making it less attractive to buyers and potentially causing a significant financial loss for current homeowners.

The long-term effects of rising sea levels can be devastating. Coastal communities may experience more frequent and severe storm surges, leading to extensive property damage and potentially rendering homes uninhabitable. The increasing frequency of these events can create an environment of uncertainty, deterring investment and further impacting the value of coastal real estate.

Insurance and Mitigation Strategies

Rising insurance premiums are a critical concern for coastal property owners. As the risk of flooding and damage increases, insurance companies are forced to adjust their rates accordingly. This can make coastal properties prohibitively expensive to insure, impacting both current owners and potential buyers. Additionally, the costs associated with implementing mitigation strategies, such as seawalls or drainage systems, can be substantial and further contribute to the financial burden faced by those living in vulnerable areas.

Understanding the specific risks and implementing appropriate mitigation strategies is crucial. Homeowners can explore various options, including elevation of structures, improved drainage systems, and the use of flood-resistant materials. However, these measures often require significant financial investment and may not always be effective in completely preventing damage from future events.

Economic Consequences for Coastal Communities

The decline in coastal property values has far-reaching economic consequences for coastal communities. Reduced investment, decreased tourism, and job losses in the construction and real estate sectors can create a cascading effect, impacting local economies and potentially leading to a decline in the overall quality of life. The loss of valuable tax revenue from reduced property values can also create a challenge for local governments, impacting their ability to provide essential services.

Future Projections and Adaptation

Future projections for sea-level rise indicate a potentially significant increase in coastal vulnerability. Understanding these projections and adapting to the changing landscape is paramount for protecting both coastal property values and the livelihoods of residents. This requires a comprehensive approach that includes proactive measures such as land-use planning, infrastructure improvements, and the development of resilient coastal communities. Government policies and international cooperation are crucial in addressing this global challenge and providing support for affected communities.

Extreme Weather Events and Insurance Implications

Understanding the Impact of Extreme Weather

Extreme weather events, such as hurricanes, floods, wildfires, and heatwaves, are becoming increasingly frequent and intense due to climate change. These events pose a significant threat to individuals, communities, and businesses, causing substantial damage to property and infrastructure. Understanding the specific impacts of these events on insurance policies is crucial for both policyholders and insurers. The rising frequency and severity of extreme weather necessitate a proactive approach to risk assessment and mitigation.

The financial consequences of extreme weather events can be devastating. Homes, businesses, and critical infrastructure can be destroyed, leading to substantial repair costs and potentially long-term economic disruption. These events often trigger widespread claims, straining insurance company resources and potentially impacting their financial stability. The ability of insurance systems to effectively manage and respond to these events is paramount in minimizing the societal and economic fallout.

Insurance Policy Coverage and Exclusions

Insurance policies often have specific clauses outlining coverage for damage caused by extreme weather. These clauses can be complex and vary significantly depending on the type of policy, the location, and the specific event. It's crucial for policyholders to carefully review their policy documents to understand what is and isn't covered.

Many policies exclude coverage for damage caused by certain types of extreme weather events, such as floods, earthquakes, and certain types of wildfire damage. Policyholders need to understand these exclusions to avoid disappointment or confusion when a claim is filed. Knowing what is excluded is just as important as knowing what is covered. The details of coverage and exclusions can vary significantly between providers. This necessitates thorough research and comparison before purchasing insurance.

Adapting to a Changing Climate and Insurance Strategies

As climate change continues to exacerbate the frequency and intensity of extreme weather events, insurance companies are adapting their strategies to address the evolving risks. This involves a range of measures, including enhanced risk assessment models, increased premium adjustments, and the development of new insurance products.

Insurers are increasingly incorporating climate change projections into their risk assessments, recognizing the growing need to accurately assess and price the risks associated with extreme weather. This shift towards more sophisticated risk modeling is essential for ensuring the financial stability of the insurance industry and its ability to effectively respond to future claims. This adaptation also requires policyholders to be proactive in protecting their assets from potential damage.

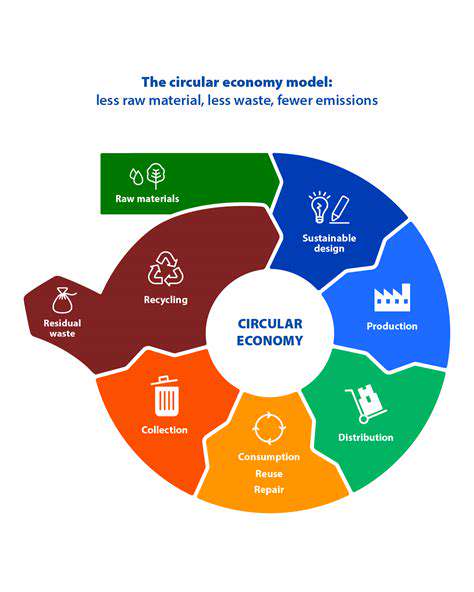

Sustainable Development and Green Building Practices

Integrating Sustainable Design into Real Estate Projects

Sustainable development is no longer a niche concept but a crucial component of responsible real estate practices. Integrating green building principles from the initial design phases, through construction, and finally into the operational lifecycle of a building is vital to mitigating the environmental impact of real estate projects. This includes careful consideration of material sourcing, energy efficiency, water conservation, and waste reduction strategies. By embracing these principles, developers can create properties that are not only environmentally friendly but also economically viable in the long run.

Adopting sustainable design minimizes the buildings' carbon footprint and promotes a healthier environment for occupants. This approach considers the entire lifecycle of a building, from the extraction of raw materials to the end-of-life disposal, ensuring minimal environmental damage at every stage.

The Role of Energy Efficiency in Green Buildings

Energy efficiency is a cornerstone of sustainable development in real estate. Green buildings prioritize the use of energy-efficient appliances, lighting systems, and building envelopes to minimize energy consumption. This not only reduces operational costs for building owners but also significantly lowers greenhouse gas emissions, contributing to a healthier planet. Careful consideration of solar energy integration and smart building technologies further enhances energy efficiency.

Innovative technologies, such as smart thermostats and automated lighting controls, allow for precise and dynamic energy management, leading to substantial savings and a reduced environmental impact. These strategies are not only beneficial for the environment but also enhance the building's economic performance.

Water Conservation Strategies in Green Building

Water conservation is another critical aspect of sustainable real estate development. Green building practices incorporate water-efficient fixtures, landscaping designs, and greywater recycling systems. This proactive approach significantly reduces water consumption within the building while also minimizing the strain on local water resources. By implementing these strategies, developers can contribute to water sustainability in the communities where they operate.

Material Selection and Waste Management

The choice of building materials plays a significant role in a building's environmental footprint. Sustainable development in real estate emphasizes the use of recycled and locally sourced materials whenever possible. This reduces the transportation-related emissions associated with material delivery and minimizes the demand for raw materials from environmentally sensitive areas. Furthermore, effective waste management strategies, including recycling and composting programs, are essential components of a truly sustainable building.

Financial Incentives and Regulatory Compliance

Implementing sustainable development practices often comes with financial incentives, such as tax credits and rebates for environmentally friendly building materials and energy-efficient technologies. Understanding and leveraging these incentives can reduce the initial investment costs associated with sustainable construction. Furthermore, compliance with relevant environmental regulations is crucial for responsible real estate development. Developers must adhere to building codes and standards to ensure that the constructed buildings meet the necessary sustainability criteria.

Read more about Real Estate and Climate Change: A Global Perspective

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing