AI Powered Valuation: Optimizing Real Estate Investment Decisions

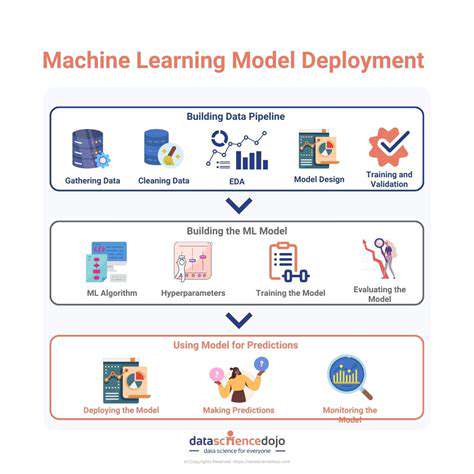

Advanced computational models, including multivariate regression and deep learning architectures, serve as the core components of contemporary valuation systems. These systems digest historical transaction patterns, discerning relationships between property attributes and their corresponding market prices. The adaptive nature of these algorithms enables continuous refinement as market dynamics shift, maintaining valuation relevance amid fluctuating economic conditions.

Data Enrichment and Quality Control: Ensuring Reliable Results

Valuation precision depends fundamentally on data integrity and scope. Comprehensive data augmentation protocols supplement basic public records with supplementary details such as recent neighborhood transactions, structural improvements, and regional economic health indicators. Stringent verification procedures identify and rectify dataset anomalies, producing more dependable valuation conclusions.

The Role of Real-Time Market Data Integration: Staying Ahead of Trends

Immediate market data assimilation proves indispensable for current valuation accuracy. This constant stream of updated information - encompassing fresh sales, active listings, and economic developments - ensures models remain responsive to market fluctuations. Such dynamic adaptation proves essential for delivering timely and precise property assessments.

Transparency and Explainability in Algorithmic Appraisal

Clarity and interpretability have become paramount in automated valuation systems. Stakeholders require comprehensible explanations regarding valuation methodologies, including specific parameter consideration and weighting. This openness builds confidence and enables critical evaluation, strengthening overall trust in the valuation process.

Overcoming Challenges and Addressing Bias in Algorithmic Appraisal

Despite notable advantages, automated valuation systems face persistent challenges. A primary concern involves neutralizing potential biases embedded within training datasets. Careful curation must ensure representative sampling that doesn't perpetuate existing market prejudices. Resolving these issues remains vital for establishing fair, objective valuation frameworks.

The Future of Algorithmic Appraisal: Integration and Evolution

Automated valuation technology continues progressing through expanded data integration, refined analytical models, and advanced bias detection mechanisms. Seamless incorporation of these advancements into existing appraisal workflows will prove crucial for enhancing operational efficiency throughout the real estate sector.

Beyond Traditional Methods: Unveiling the Potential of Big Data

Leveraging Predictive Analytics for Enhanced Accuracy

Comprehensive data analysis enables more nuanced valuation approaches than conventional methods. By processing extensive datasets containing market movements, historical transactions, and socioeconomic metrics, advanced algorithms detect intricate patterns often missed by traditional analysis. This facilitates deeper understanding of asset valuation, yielding more precise and dependable assessments. Predictive capabilities allow dynamic valuation adjustments based on forecasted market conditions, proving particularly valuable in volatile markets.

Incorporation of unstructured data sources - including media coverage and social discourse - substantially enriches the valuation process. This expanded dataset captures intangible market influences, resulting in more holistic asset evaluations that better reflect complex market realities.

Improving Efficiency and Reducing Bias through Automation

Automated valuation systems overcome limitations inherent in manual processes by minimizing subjective judgments and human error. Streamlined data collection and analysis significantly reduces processing times while enhancing accessibility to valuation services. The objective nature of algorithmic analysis helps identify and correct potential biases, fostering greater equity in property assessments.

This impartial approach proves especially beneficial in diverse markets, where automated systems can provide more accurate valuations for traditionally underrepresented property types or neighborhoods.

Enhancing Efficiency and Speed: Streamlining the Valuation Process

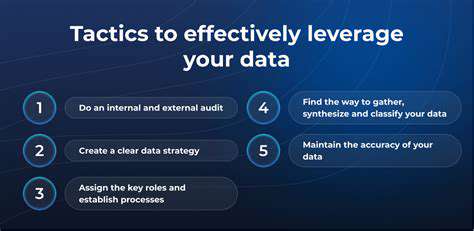

Optimizing Workflow Processes

Process optimization significantly improves operational efficiency. Standardized protocols combined with automation tools reduce manual workload, allowing focus on value-added activities. Systematic identification and resolution of workflow bottlenecks leads to measurable improvements in productivity and turnaround times.

Leveraging Technology

Contemporary technological solutions dramatically enhance operational efficiency. Integration of advanced software platforms and cloud-based systems facilitates information sharing and accelerates decision-making. Strategic technology adoption automates routine tasks while improving data management and cross-departmental collaboration.

Improving Communication

Effective organizational communication significantly impacts operational efficiency. Clearly defined communication channels and responsibilities minimize misunderstandings while accelerating decision cycles. Regular team coordination and comprehensive documentation collectively enhance workplace productivity.

Training and Skill Development

Targeted employee development programs substantially improve workforce efficiency. Comprehensive training initiatives combined with continuous learning opportunities empower staff to perform tasks more effectively. These investments in human capital yield long-term operational improvements.

Improving Investment Decision-Making: Data-Driven Insights for Optimal Returns

Understanding Investment Strategies

Strategic capital allocation forms the foundation of sustained financial success. Effective strategies balance risk management with return optimization through diversified asset allocation. Comprehensive understanding of various investment vehicles enables informed decision-making aligned with personal financial objectives.

Analyzing Market Trends and Economic Factors

Market analysis incorporating economic indicators provides valuable investment insights. Monitoring GDP fluctuations, employment statistics, and inflation trends helps anticipate market movements. This analytical approach facilitates timely strategic adjustments in response to changing economic conditions.

Implementing and Monitoring Investment Portfolios

Consistent portfolio evaluation ensures continued alignment with investment goals. Regular rebalancing maintains desired asset distribution while accommodating market fluctuations. Ongoing performance monitoring enables informed adjustments to investment strategies over time.

The Future of Real Estate Investment: Embracing AI for Competitive Advantage

Predictive Analytics for Informed Decisions

Advanced analytical capabilities transform real estate investment strategies. Comprehensive data analysis identifies promising investment opportunities through detailed market and demographic evaluation. These sophisticated models detect subtle market patterns, enabling more accurate risk and return assessments.

Automated Property Management and Efficiency

Intelligent automation streamlines property operations from tenant relations to maintenance coordination. Automated systems enhance response efficiency while optimizing property upkeep schedules. This operational streamlining allows focus on strategic portfolio management.

Personalized Investment Strategies

Customized investment approaches match individual risk profiles and financial objectives. Tailored portfolio recommendations based on comprehensive analysis optimize investment outcomes for specific needs.

Enhanced Due Diligence and Risk Assessment

Comprehensive evaluation processes identify potential investment risks and opportunities. Detailed analysis of property documentation and market conditions facilitates more informed investment decisions. These advanced assessment capabilities improve overall investment quality while reducing potential losses.