Climate Risk and Mortgage Lending: What You Need to Know

Assessing Property Vulnerability to Climate Hazards

Identifying Potential Threats

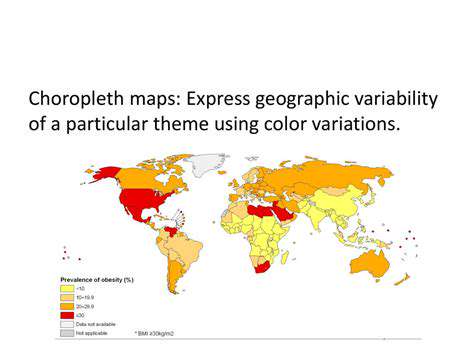

Property vulnerability assessments must start by meticulously identifying the potential threats that a given property might face. This involves a comprehensive review of the local environment, considering factors such as proximity to floodplains, seismic activity zones, and potential for severe weather events. Thorough research and data analysis are crucial to accurately assess these risks. Understanding historical patterns of natural disasters in the area is also important for predicting future vulnerabilities.

A critical aspect of identifying threats is also considering human-made hazards. These can include things like proximity to industrial facilities, potential for infrastructure failures, or even the likelihood of criminal activity. This comprehensive approach ensures a complete picture of potential risks.

Evaluating Existing Infrastructure

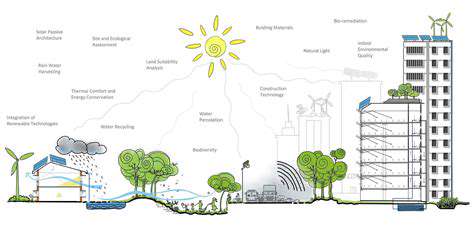

A crucial step in assessing property vulnerability is evaluating the existing infrastructure. This includes examining the structural integrity of the property, including the foundation, walls, roof, and any other critical components. Careful inspection and documentation are necessary to pinpoint potential weaknesses. This evaluation must also include an assessment of the condition of the property's systems, such as plumbing, electrical, and HVAC, to identify any potential failure points.

Analyzing Building Materials and Design

The composition of the building materials used in a property's construction significantly impacts its vulnerability. Factors like the type of wood, concrete, or metal used, along with the overall design, influence the property's resilience to various threats. An in-depth analysis of these materials and their susceptibility to damage is essential for a thorough assessment. For example, older buildings might have materials that are more susceptible to moisture damage, while newer constructions may use materials with enhanced resistance to specific threats.

Considering Geographic Location and Environment

The geographic location and surrounding environment significantly influence a property's vulnerability. Factors such as proximity to water sources, elevation, and soil type all play a role in determining the property's susceptibility to flooding, landslides, or other natural hazards. A thorough understanding of the local topography and climate patterns is paramount for accurate risk assessment. Environmental factors like vegetation and proximity to wetlands also contribute to the overall vulnerability profile.

Assessing Occupant Behavior and Preparedness

It is important to consider the behavior and preparedness of the occupants of the property when evaluating its vulnerability. This involves understanding how occupants might react to a disaster and how prepared they are to deal with emergencies. A well-prepared occupant is a vital part of the overall property resilience. This evaluation might include looking at the property's emergency plan, the occupants' evacuation strategies, and any existing safety protocols.

Evaluating Potential Impacts and Consequences

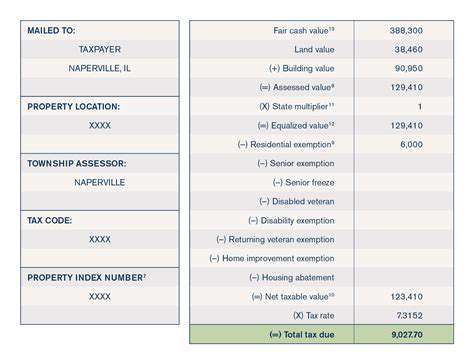

Assessing the potential impacts and consequences of a threat is a critical component of a property vulnerability assessment. This involves estimating the likely extent of damage, potential financial losses, and the possible disruption to the occupants' lives. Understanding the potential costs and long-term consequences will help to prioritize mitigation strategies. This should include not only the immediate impacts but also the long-term effects on the property and its occupants.

Developing Mitigation Strategies

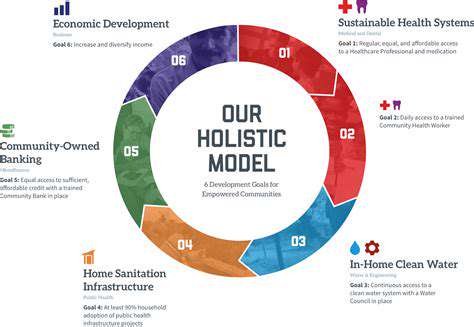

A property vulnerability assessment should culminate in the development of effective mitigation strategies. These strategies should address the specific vulnerabilities identified in the assessment and propose practical solutions to enhance the property's resilience. Identifying cost-effective measures to reduce the risk of damage is crucial to making informed decisions. These strategies could range from reinforcing structural components to implementing early warning systems or creating evacuation plans.

The Financial Implications of Climate-Related Damage

The Impact on Investment Portfolios

Climate change poses a significant threat to various investment sectors, from fossil fuel-dependent industries to real estate and agriculture. The transition to a low-carbon economy necessitates substantial shifts in investment strategies, potentially impacting the returns of existing portfolios. Investors need to understand the risks associated with companies and assets reliant on carbon-intensive activities, as well as the opportunities presented by the growing renewable energy and sustainable technology sectors. This necessitates a thorough analysis of environmental, social, and governance (ESG) factors in investment decisions. The financial implications extend beyond direct exposure to specific industries, influencing broader market trends and potentially causing significant disruptions.

Investors need to anticipate the potential for stranded assets – assets that lose their value due to shifts in regulations or consumer preferences. Understanding these risks and proactively incorporating sustainability considerations into investment decisions is crucial for long-term portfolio performance. Early adoption of sustainable practices can potentially offer a competitive advantage and mitigate the financial risks associated with climate change. This involves careful due diligence and a shift from traditional financial metrics to incorporate ESG factors.

The transition to a sustainable economy is creating new investment opportunities in renewable energy, energy efficiency, and sustainable infrastructure. This presents a huge potential for growth and profitability, but careful analysis is vital. Investors need to identify companies and projects that are likely to thrive in this evolving landscape. Early identification and investment in these areas can create strong returns while contributing to a more sustainable future.

The Shift in Regulatory Landscapes

Governments worldwide are implementing increasingly stringent environmental regulations and policies to mitigate climate change. These regulations affect various sectors, including energy, transportation, and manufacturing. This shift in the regulatory landscape necessitates businesses to adapt and invest in green technologies and sustainable practices to remain compliant and competitive.

The financial implications of these regulations are significant. Companies that fail to adapt to the changing regulatory landscape face substantial fines, operational disruptions, and reputational damage. This can lead to a substantial decrease in profitability and even business closure. Companies that proactively embrace sustainability can gain a competitive edge and enhance their long-term prospects. The costs associated with compliance can be significant in the short term, but they can be offset by long-term gains in efficiency, cost savings, and access to new markets.

International agreements and carbon pricing mechanisms are also influencing financial markets. These agreements and mechanisms are designed to incentivize emission reductions and encourage investment in clean energy. The evolving nature of these regulations and their potential impact on different sectors will need to be carefully monitored. Understanding these trends is key to managing risk and identifying opportunities.

Read more about Climate Risk and Mortgage Lending: What You Need to Know

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

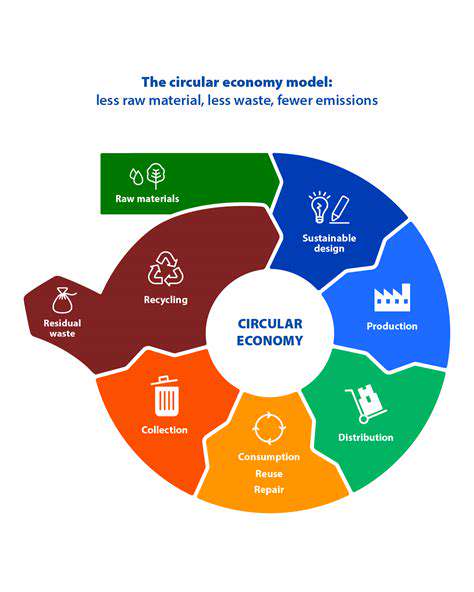

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing