Green Mortgages: Benefits for Developers and Buyers

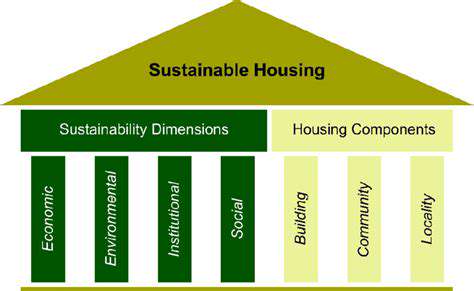

The Rising Demand for Sustainable Housing

The Growing Environmental Consciousness

Consumers are increasingly aware of the environmental impact of their choices, and this heightened awareness is driving a significant shift in demand for sustainable products and services. People are actively seeking ways to reduce their ecological footprint, and this translates directly into a preference for companies that prioritize sustainability in their operations and supply chains. This growing consciousness is a key driver of the rising demand for sustainable solutions across various sectors.

Economic Incentives and Regulations

Governments and businesses are recognizing the need for sustainable practices, leading to the implementation of supportive policies and regulations. Incentives, such as tax breaks for eco-friendly initiatives and stricter environmental regulations, are encouraging companies to adopt sustainable practices and consumers to make sustainable choices. This combination of economic pressures and regulatory frameworks is directly influencing the market demand for sustainable products.

Technological Advancements

The development of innovative technologies is playing a crucial role in advancing sustainable practices. From renewable energy sources to eco-friendly manufacturing processes, technological breakthroughs are making it more feasible and cost-effective for businesses to embrace sustainability. These advancements are not only creating new opportunities but also reducing the barriers to entry for sustainable solutions in the market.

Consumer Preferences and Lifestyle Changes

Consumer preferences are evolving, with a growing segment seeking products and services that align with their values and commitments to sustainability. This shift is being driven by a broader cultural movement towards environmentally conscious lifestyles, which is further fueling the demand for sustainable products and services. Consumers are actively choosing brands that demonstrate a commitment to sustainability, and this preference is having a profound impact on business strategies.

Supply Chain Sustainability

The focus on sustainable supply chains is becoming increasingly important. Companies are recognizing the need to ensure their entire supply chain is environmentally responsible, from raw material sourcing to manufacturing and distribution. Sustainable supply chains are not just a desirable feature but are becoming a critical factor in gaining and retaining consumer trust. This emphasis on transparency and ethical sourcing is essential to meet the demands of consumers who are increasingly scrutinizing the entire lifecycle of a product.

Market Opportunities and Growth Potential

The increasing demand for sustainable products and services presents significant market opportunities for businesses across various sectors. From fashion and food to energy and construction, the market for sustainable solutions is experiencing substantial growth and development. This growth potential is attracting significant investment and innovation, creating a virtuous cycle of sustainable development and economic growth. The market is ripe with opportunities for businesses that proactively embrace sustainability.

Green Mortgage Benefits for Developers

Green Mortgage Benefits for Developers

Green mortgages offer significant advantages for developers seeking to construct environmentally sustainable projects. These financing options often come with favorable interest rates and potentially lower closing costs, making them an attractive financial choice. Developers can leverage these benefits to enhance their project's marketability and appeal to environmentally conscious buyers. Furthermore, securing a green mortgage can contribute to a positive brand image, attracting investors and partners who prioritize sustainability.

By integrating green building practices into their projects, developers can demonstrate a commitment to environmental responsibility. This commitment often translates into a stronger market position. This is crucial in today's increasingly environmentally conscious market, where buyers are actively seeking homes and buildings with a reduced environmental footprint.

Reduced Financing Costs

One of the most significant advantages of green mortgages is the potential for reduced financing costs. Lenders often offer attractive interest rates and potentially lower closing costs for projects that incorporate energy-efficient features and sustainable construction methods. This translates directly to lower overall project expenses and increased profitability for the developer. This is a substantial benefit when considering the long-term financial implications of development projects.

Lower financing costs are a key driver for developers to incorporate green features into their projects. This is because the cost savings outweigh the initial investment in sustainable materials and technologies.

Increased Property Value

Green building practices often lead to increased property values. Homes and buildings designed with sustainability in mind typically retain or appreciate more rapidly than traditional construction. This increase in value is crucial for developers, as it directly impacts the return on investment (ROI) for their projects.

Buyers are increasingly drawn to environmentally friendly homes and buildings. Consequently, projects incorporating green technologies are more likely to attract a higher number of buyers, leading to a higher demand and a stronger market position.

Improved Market Position

Developers with green mortgages often find themselves in a stronger market position. These mortgages demonstrate a commitment to environmental sustainability, which is a highly sought-after quality among investors and buyers. This commitment can attract environmentally conscious buyers and investors, leading to higher project demand and faster sales cycles. This is a key factor in the success of development projects in the current market.

Tax Incentives and Rebates

Many jurisdictions offer tax incentives and rebates for sustainable construction practices. Developers who utilize green mortgages can often claim these incentives, leading to further reductions in project costs. These rebates and incentives can significantly contribute to the overall financial viability of the project. This makes green mortgages a financially attractive option for developers.

Enhanced Project Marketability

Projects financed by green mortgages often enjoy enhanced marketability. Buyers are increasingly interested in environmentally friendly homes and buildings, and green mortgages highlight that commitment to sustainability. This heightened interest translates directly into a greater number of potential buyers, resulting in faster sales and a higher return on investment for the developer.

Environmental Responsibility

Adopting green mortgages demonstrates a commitment to environmental responsibility. Developers can use these mortgages to showcase their dedication to sustainable practices and attract environmentally conscious clients. This commitment to sustainability is crucial in today's world, where environmental concerns are paramount. Furthermore, this demonstrates a commitment to creating a better future for the planet.

The Future of Green Mortgages

Green Mortgage Incentives

Green mortgages are increasingly attractive to both developers and buyers due to a variety of incentives. These incentives often include favorable interest rates, government tax credits, or even grants specifically designed to encourage environmentally friendly construction and home purchases. These programs aim to stimulate the market for sustainable practices by recognizing and rewarding those who prioritize eco-conscious options. This creates a positive feedback loop, driving innovation and adoption of green technologies.

Understanding these incentives is crucial for both developers and buyers to maximize the financial benefits associated with green mortgages. By taking advantage of the available support, individuals and companies can contribute to a more sustainable future while simultaneously reducing their financial burden.

Environmental Impact of Green Mortgages

The primary environmental impact of green mortgages lies in their encouragement of sustainable building practices. By offering financial advantages for homes and buildings designed with energy efficiency and eco-friendly materials in mind, these mortgages contribute to reduced carbon footprints and lower overall environmental impact. This can range from the use of solar panels to the selection of sustainable building materials, ultimately leading to a greener built environment.

Furthermore, the focus on energy efficiency fostered by green mortgages helps conserve natural resources. Reduced energy consumption translates directly into lower demands on fossil fuels and other non-renewable sources, mitigating the negative effects of environmental degradation.

Financial Benefits for Developers

For developers, green mortgages can present substantial financial benefits beyond the initial cost savings. These mortgages can often attract environmentally conscious buyers, leading to increased property values and quicker sales cycles. The potential for higher property values is a significant advantage, and the faster turnover can lead to higher overall profitability.

Additionally, developers often benefit from streamlined permitting processes and access to specialized funding programs designed to support green building projects. These benefits can lead to a more profitable and sustainable business model for developers.

Financial Benefits for Buyers

Green mortgages offer attractive financial benefits for buyers seeking energy-efficient homes. These benefits often include lower interest rates or favorable loan terms due to the reduced risk associated with these environmentally conscious properties. Buyers can save money on long-term energy costs thanks to improved insulation, energy-efficient appliances, and sustainable building designs.

The reduced energy consumption and maintenance costs associated with green homes translate into significant savings over the lifetime of the mortgage. This makes green mortgages a financially savvy choice for environmentally conscious buyers.

The Role of Government Incentives

Government incentives play a vital role in driving the adoption of green mortgages. These initiatives can include tax credits, grants, and subsidized loans, aiming to make sustainable practices more affordable and accessible to both developers and buyers. These incentives create a market environment that rewards eco-friendly choices, motivating individuals and companies to adopt greener construction and purchasing practices.

The Future of Green Mortgage Lending

The future of green mortgage lending appears promising, with increasing demand for sustainable housing solutions. This trend is likely to be driven by rising awareness of climate change and the growing desire for eco-conscious living. As awareness of environmental issues grows, the need for environmentally responsible lending practices will likely increase, leading to further development and refinement of green mortgage programs.

Technological advancements in energy efficiency and sustainable building materials will continue to drive innovation in this sector. The result will be more effective and sophisticated green mortgage options, further promoting the growth of environmentally friendly housing.

Challenges and Considerations

Despite the numerous advantages, green mortgages also present some challenges. One key consideration is the potential for higher upfront costs for sustainable materials and technologies. Developers and buyers must carefully evaluate the long-term savings against the initial investment to ensure that the benefits outweigh the costs. Another challenge lies in the need for reliable and consistent standards to ensure the quality and effectiveness of green building practices.

Additionally, there are concerns about the accessibility and affordability of green mortgages for all segments of the population. Addressing these issues will be critical to ensuring that the benefits of green mortgages are broadly shared and contribute to a more sustainable future.

Read more about Green Mortgages: Benefits for Developers and Buyers

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing