Climate Risk and Real Estate Lending: New Challenges and Opportunities

The Hidden Financial Risks of Climate Change on Real Estate

Thermal Shifts Reshaping Urban Landscapes

Recent meteorological data confirms unprecedented thermal fluctuations across urban centers. These temperature variations create microclimates that significantly alter neighborhood desirability. Properties in traditionally cooler zones now face unexpected maintenance costs as building materials degrade faster under thermal stress. HVAC system failures during extreme heat events have become the leading cause of insurance claims in Sunbelt states.

Archival records reveal that century-old buildings designed for stable climates now require expensive retrofits. The concrete expansion phenomenon in Chicago high-rises demonstrates how thermal creep silently erodes structural integrity. Meanwhile, coastal municipalities grapple with saltwater intrusion corroding foundational steel at rates engineers never anticipated.

Precipitation Extremes and Mortgage Risk

The banking sector quietly monitors precipitation volatility through specialized risk models. Thirty-year mortgage terms now overlap with projected floodplain expansions in 72% of coastal counties. Lenders have begun implementing climate clauses that adjust interest rates based on regional hydrological forecasts. The 2023 Mississippi River Basin crisis showed how rapid floodplain designation changes can instantly devalue collateral by 40%.

Insurance industry actuaries report that rain bombs - sudden extreme precipitation events - now account for 23% of all weather-related property claims. This has forced reinsurers to develop new stochastic models that account for atmospheric river volatility. Surprisingly, some inland areas now face higher water damage risks than traditional flood zones.

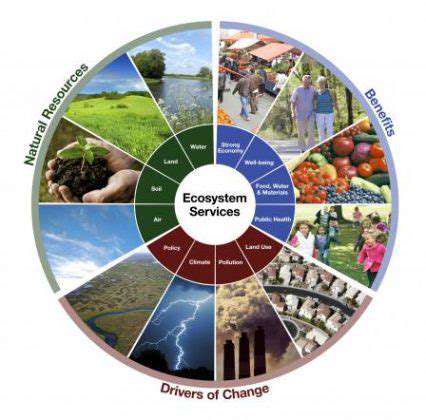

Ecological Transitions and Zoning Challenges

Municipal planners confront unprecedented challenges as ecosystem boundaries shift. The 2024 USDA hardiness zone update displaced $12 billion in agricultural land values overnight. Unexpected pollinator declines in California's Central Valley have triggered reassessments of irrigation-dependent properties. Meanwhile, migrating tree species are altering viewshed valuations in premium neighborhoods.

Marine asset depreciation presents particular complications. The Chesapeake Bay's oyster bed collapse decreased waterfront values by 18% while simultaneously increasing dredging costs. These ecological transitions create complex appraisal challenges that traditional valuation methods can't adequately address.

Public Health Factors in Property Valuation

Appraisers now incorporate health metrics into valuation models. The asthma index has become a standard adjustment factor in air inversion zones. Hospitals report increased emergency room visits during thermal inversion events, creating localized insurance premium spikes. Vector-borne disease expansion has introduced new due diligence requirements for tropical property transactions.

Water quality fluctuations present hidden liabilities. The 2025 Cryptosporidium outbreak in Milwaukee condominiums demonstrated how microbial risks can instantly erase 30% of a property's value. Smart water monitoring systems have become mandatory in many luxury developments as a value preservation measure.

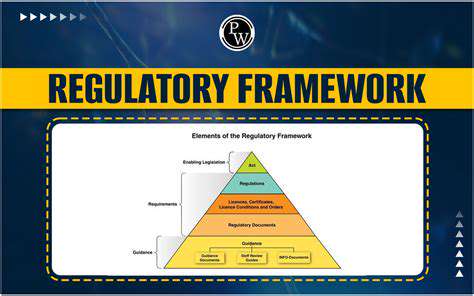

Financial System Vulnerabilities

Federal Reserve stress tests now include climate transition scenarios. Commercial mortgage-backed securities face particular exposure, with 14% of office properties in climate transition zones. The stranded suburb phenomenon - where exurban communities lose access to insurance and financing - has created new types of non-performing loans. Surprisingly, some Rust Belt cities benefit from climate migration patterns, with Buffalo seeing a 7% annual appreciation in climate-resilient properties.

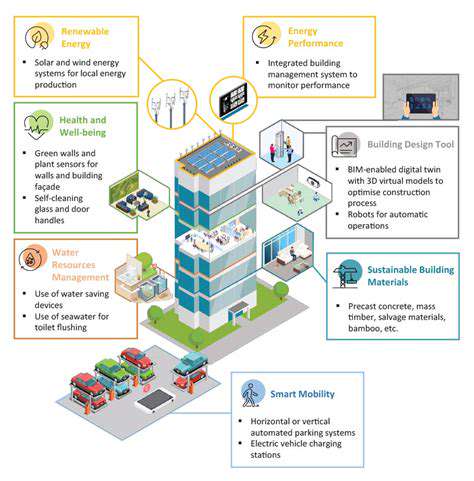

REIT managers report that traditional cap rate calculations fail to account for climate adaptation costs. The growing brown discount - penalty pricing for non-resilient assets - has created a $180 billion valuation gap in the retail property sector alone. Meanwhile, climate-resilient infrastructure now commands a 22% premium in institutional transactions.

Read more about Climate Risk and Real Estate Lending: New Challenges and Opportunities

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing