The Future of Real Estate with AI and Data

Predictive Analytics for Enhanced Market Insights

Predictive Modeling Techniques

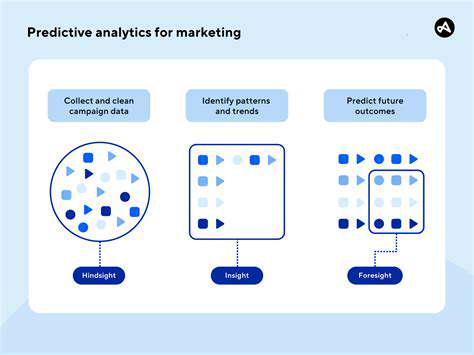

Predictive analytics employs diverse statistical and machine learning methods to anticipate future outcomes. These models analyze historical data to uncover patterns, trends, and relationships that help forecast upcoming events. The procedure requires careful algorithm selection, thorough data preparation, and rigorous performance evaluation. When executed properly, these models generate valuable forecasts that support decision-making across industries from finance to healthcare.

The choice of modeling technique depends on both the data characteristics and desired predictions. Linear regression works well for continuous variable prediction, while classification algorithms like logistic regression handle categorical outcomes effectively. Advanced methods such as neural networks can decode complex, non-linear data relationships. Selecting the optimal technique remains fundamental to developing reliable predictive capabilities.

Data Preparation and Feature Engineering

The foundation of any robust predictive model lies in meticulous data preparation. Initial steps involve cleansing datasets by addressing missing values, outliers, and inconsistencies. Feature engineering—creating new variables or transforming existing ones—can dramatically enhance model performance. This process benefits greatly from subject matter expertise to recognize meaningful features and their predictive potential.

Techniques like normalization and standardization help balance feature influences within models. Proper handling of categorical variables and data scaling prevents bias and improves accuracy. Data preparation typically involves multiple refinement cycles to optimize model effectiveness through continuous adjustments.

Model Evaluation and Validation

Assessing model performance is critical for ensuring reliability and effectiveness. Common evaluation metrics include accuracy, precision, recall, and F1-score, which reveal model strengths and areas needing improvement. These measurements guide necessary refinements to enhance predictive capabilities. Cross-validation techniques, dividing data into training and testing sets, help evaluate generalization potential and prevent overfitting.

Recognizing model limitations remains equally important. No predictive model achieves perfection, and some data aspects may elude capture. Continuous monitoring and periodic updates ensure models maintain accuracy as new data emerges. This ongoing maintenance preserves the model's value for informed decision-making.

Applications of Predictive Analytics

Predictive analytics demonstrates remarkable versatility across industries. Financial institutions utilize it for stock price forecasting, credit risk assessment, and fraud detection. Healthcare applications include predicting patient readmissions, identifying disease risks, and optimizing treatment protocols. Marketing teams leverage predictions for customer retention strategies, campaign personalization, and dynamic pricing.

The technology also enhances supply chain efficiency, predicts equipment maintenance needs, and strengthens risk management frameworks. This widespread applicability highlights how predictive analytics transforms decision-making processes across sectors. By anticipating future developments, organizations gain strategic advantages through proactive planning.

Automated Processes and Streamlined Transactions

Automating Routine Tasks

Modern automation technologies revolutionize business operations by eliminating repetitive manual tasks. This transformation allows employees to concentrate on higher-value strategic work and complex problem-solving. The resulting productivity gains and error reduction significantly improve operational efficiency and profitability. Automated systems maintain consistent accuracy that manual processes often struggle to match.

Consider traditional data entry operations requiring hours of manual work. Automation completes these tasks rapidly with perfect accuracy, while freeing staff for more meaningful customer engagement. This transition typically enhances both operational metrics and customer satisfaction simultaneously.

Optimizing Resource Allocation

Automation enables precise resource optimization by identifying operational inefficiencies in real-time. Continuous monitoring of key performance indicators reveals underutilized or wasted resources. Data-driven insights facilitate proactive adjustments that maximize efficiency and reduce costs.

Automated inventory systems exemplify this advantage by tracking stock levels, predicting demand, and initiating replenishment orders automatically. This eliminates manual inventory management while preventing both shortages and excess inventory situations.

Improving Accuracy and Consistency

Automated systems significantly reduce error rates compared to manual processes, especially when handling large data volumes. The inherent precision of automation minimizes mistakes, producing higher quality outputs with less rework required.

Enhancing Scalability and Flexibility

Businesses gain operational agility through automation, which easily scales to accommodate fluctuating demand. This adaptability provides competitive advantages in dynamic market conditions.

Automation frameworks also simplify adoption of new technologies and business requirements, ensuring smooth operational transitions without major disruptions.

Reducing Operational Costs

Process automation generates substantial long-term cost savings by reducing labor requirements and improving efficiency. These reductions directly improve profitability through lower operational expenses.

Automated systems also decrease oversight needs, creating additional cost efficiencies, particularly in labor-intensive industries. The combined effect includes better resource utilization and reduced waste across operations.

The Future of Real Estate Data Management and Security

Real Estate Data Integration

Advanced real estate strategies require seamless integration of diverse data sources including property details, market trends, and environmental factors. This comprehensive data fusion enables deeper market understanding and more accurate property valuation. Both buyers and sellers benefit from these enhanced insights during transaction processes.

Integrated data systems allow faster identification of emerging trends and market shifts. Timely access to synthesized information forms the foundation for successful real estate strategies moving forward.

Predictive Analytics

Future real estate decisions will increasingly rely on predictive analytics combining historical data with current market conditions. These projections enable proactive investment strategies rather than reactive responses.

Accurate forecasts of price movements become essential tools for all market participants, replacing intuition-based decisions with data-driven approaches.

AI-Powered Property Valuation

Artificial intelligence transforms valuation processes through advanced pattern recognition in large datasets. AI identifies valuation factors that traditional methods might overlook.

AI-driven valuation accelerates transactions while potentially reducing associated costs, benefiting lenders, buyers, and sellers alike.

Data Visualization and User Experience

Complex real estate data requires intuitive visualization tools for effective interpretation. Well-designed visual representations make sophisticated market analysis accessible to professionals and consumers.

Interactive platforms enable dynamic data exploration, revealing hidden patterns and enhancing user engagement with property information.

The Role of Blockchain Technology

Blockchain's secure, transparent ledger system promises to transform real estate transactions. Its fraud prevention capabilities prove particularly valuable for high-value and cross-border property deals.

Ethical Considerations and Data Privacy

Expanding real estate data usage demands rigorous ethical standards and privacy protections. Clear guidelines must govern sensitive information collection and usage.

Maintaining data integrity and implementing robust security measures builds essential trust in real estate data systems. Preventing breaches and misuse remains critical for sustainable market growth.

Read more about The Future of Real Estate with AI and Data

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing