Climate Adaptation Finance for Real Estate Projects

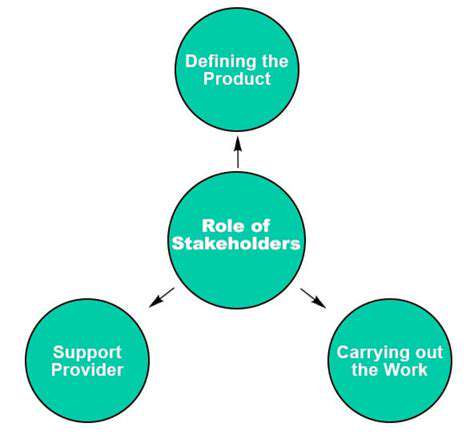

When governments and businesses join forces through public-private partnerships (PPPs), they create powerful engines for climate adaptation. These strategic alliances combine public oversight with private sector efficiency, unlocking unprecedented financial resources for climate solutions. The real magic happens when flood-resistant infrastructure projects get built faster and agricultural innovations reach farmers sooner through these collaborative efforts.

Successful PPPs thrive on crystal-clear agreements that spell out each partner's contributions and expectations. Regular progress reports and open communication channels help maintain trust throughout multi-year projects. This transparency transforms what could be bureaucratic hurdles into springboards for innovation, particularly in developing novel financial tools tailored to climate adaptation needs.

Government Grants and Subsidies: Incentivizing Investment

Strategic government funding acts as a catalyst for climate adaptation by making critical projects financially viable. Well-designed grant programs can mean the difference between a community installing flood barriers or remaining vulnerable. Farmers particularly benefit when subsidies help transition to drought-resistant crops without bearing the full financial risk.

The most effective programs use simple application processes combined with rigorous evaluation metrics. By tracking everything from water savings to infrastructure durability, administrators can continuously refine their funding approaches. Regional adaptation funds that respond to local conditions often outperform one-size-fits-all national programs.

Carbon Markets and Offset Mechanisms: Incentivizing Emission Reductions

Modern carbon markets create financial incentives for climate-smart practices through an elegant market mechanism. When a tech company offsets emissions by funding mangrove restoration, both carbon reduction and coastal protection advance simultaneously. These markets work best when verification protocols leave no room for doubt about environmental benefits.

Emerging blockchain solutions are bringing unprecedented transparency to carbon credit tracking. International standards now help ensure reforestation projects in Brazil deliver measurable benefits comparable to renewable energy investments in India. This global framework prevents double-counting while expanding adaptation funding sources.

Microfinance Initiatives: Supporting Vulnerable Communities

Small-scale lending programs empower grassroots climate adaptation in ways large institutions cannot replicate. A $500 loan for a rainwater harvesting system can transform a family's resilience overnight. Community lending circles often achieve remarkable repayment rates when members collectively vet projects and share best practices.

Insurance and Risk Transfer Mechanisms: Managing Climate Risks

Innovative insurance products are rewriting the rules of climate risk management. Parametric insurance that pays out when specific weather thresholds are crossed provides rapid relief after disasters. These financial instruments work best when paired with resilience-building requirements, creating incentives for preventive measures alongside protection.

Developing countries now benefit from regional risk pools that spread exposure across multiple nations. These mechanisms demonstrate how financial innovation can make climate adaptation accessible even in vulnerable regions with limited traditional insurance markets.

International Cooperation and Funding: Collaborative Action

Global climate challenges demand coordinated financial responses. The most effective international funds combine financial support with technology transfer and local capacity building. When developed nations invest in adaptation projects abroad, they often gain valuable insights applicable to their own climate challenges.

Knowledge-sharing platforms are amplifying the impact of every adaptation dollar spent. A flood control technique perfected in Bangladesh might prevent disasters in Louisiana, while drought lessons from Australia could benefit farmers in Kenya. This global exchange accelerates adaptation progress worldwide.

Assessing Risk and Return in Climate-Resilient Real Estate Investments

Understanding the Core Concepts

Smart investors recognize that climate resilience impacts both risk profiles and return potential. Properties with flood defenses and energy-efficient systems increasingly command premium valuations as climate risks become more apparent. This shift reflects growing market recognition that resilience equals long-term value preservation.

Forward-thinking investors now analyze climate projections alongside traditional financial metrics. A commercial building's flood risk in 2050 may matter more than its current occupancy rates when considering a 30-year investment horizon.

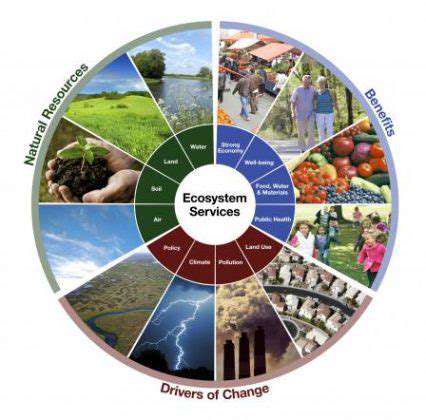

Identifying Climate-Related Risks

Modern risk assessment goes far beyond flood zone maps. Sophisticated investors now evaluate climate beta - how asset values might fluctuate with increasing climate volatility. They consider everything from changing precipitation patterns affecting agricultural land to heatwave impacts on retail foot traffic.

Transition risks require equal attention - a coastal hotel might face both rising sea levels and changing vacation patterns as travelers avoid climate-vulnerable destinations. The most comprehensive analyses weigh physical and transition risks simultaneously.

Evaluating Return Potential in a Changing Climate

Climate-smart properties increasingly outperform conventional assets across multiple metrics. Buildings with passive cooling designs and on-site renewable energy often achieve higher net operating incomes while facing lower climate-related expenses. These advantages compound over time as climate impacts intensify.

Investors now track resilience premiums - the additional value markets assign to climate-adapted properties. This premium reflects both risk reduction and growing tenant demand for future-proof spaces.

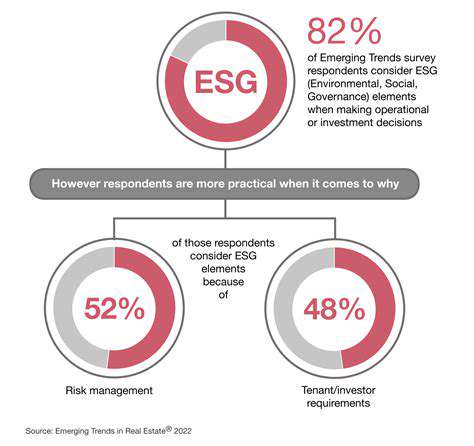

Integrating Climate Considerations into Investment Strategies

Leading investment firms now treat climate analysis as a core competency rather than a compliance exercise. Portfolio managers who understand climate physics can spot undervalued resilient assets before broader markets adjust. They actively reposition portfolios toward regions and property types with favorable long-term climate outlooks.

The most forward-looking strategies incorporate climate scenario testing across multiple time horizons. This approach helps identify assets that will thrive in various possible climate futures rather than just the most likely projections.