AI in Real Estate: Optimizing Property Valuations for Smarter Investment Decisions and Outcomes

Predictive Modeling for Future Market Trends

Understanding the Power of Predictive Modeling

Predictive modeling, a cornerstone of artificial intelligence (AI), plays a crucial role in analyzing historical data and identifying patterns to forecast future market trends. In the real estate sector, this translates to understanding factors like housing demand, supply, interest rates, and economic indicators to anticipate price fluctuations, rental yields, and overall market performance. This allows stakeholders, from investors to property managers, to make informed decisions and optimize their strategies for maximizing returns and minimizing risks within the dynamic real estate landscape.

By leveraging sophisticated algorithms and machine learning techniques, predictive models can identify subtle correlations and trends often missed by traditional methods. This deeper understanding allows for more accurate forecasts, enabling proactive responses to market shifts and opportunities. The ability to anticipate future market trends empowers real estate professionals to adapt their strategies in a way that maximizes efficiency and profitability.

Key Factors Influencing Real Estate Market Predictions

Numerous factors contribute to the accuracy of predictive models in real estate. Understanding these factors is essential for developing effective and reliable forecasts. Location, economic conditions, and local demographic shifts all play significant roles in shaping market trends. Analyzing historical data on these variables, along with current economic indicators, allows for a more comprehensive understanding of potential future market developments.

For example, a model predicting future housing prices might incorporate data on local job growth, interest rates, population density, and even the presence of new infrastructure projects. The more comprehensive and accurate the input data, the more reliable the predictions will be. This detailed understanding allows real estate professionals to adapt their strategies to capitalize on emerging opportunities and mitigate potential risks.

Optimizing Property Strategies with Predictive Insights

Predictive modeling offers significant opportunities for optimizing property strategies. By understanding future market trends, investors can make more informed decisions about property purchases, renovations, and rental strategies. For example, identifying an upcoming increase in demand for certain property types allows for strategic investment in those areas, potentially leading to higher returns.

Furthermore, predictive models can assist in determining optimal pricing strategies for properties, maximizing potential revenue. This capability allows real estate professionals to proactively adjust their pricing based on market fluctuations, ensuring competitiveness and maximizing profitability. Predictive insights can also help identify areas with high potential for appreciation, enabling investors to focus their resources on properties with the best prospects for long-term growth.

Real estate professionals can also leverage predictive insights to anticipate and mitigate potential risks. Identifying potential market downturns allows for proactive adjustments to minimize losses or capitalize on opportunities.

Predictive modeling empowers real estate businesses to make data-driven decisions, ultimately leading to better investment outcomes and improved profitability.

The results are clear: AI-powered predictive modeling is no longer a futuristic concept; it's a powerful tool transforming the real estate landscape. By leveraging this technology, real estate professionals can make more informed decisions, optimize their strategies, and ultimately achieve greater success.

Enhanced Decision-Making Through Data-Driven Insights

Leveraging AI for Market Analysis

AI-powered tools can analyze vast amounts of real estate data, including market trends, property values, and competitor activities. This comprehensive analysis allows for a deeper understanding of the local market, enabling informed decisions regarding pricing strategies, investment opportunities, and property selection. By identifying emerging trends and patterns, real estate professionals can proactively adapt to market fluctuations and capitalize on opportunities that might otherwise be missed. This data-driven approach minimizes risk and maximizes potential return on investment.

Real estate professionals can utilize AI algorithms to predict future market behavior based on historical data and current market conditions. This predictive analysis helps in making strategic decisions about property purchases, sales, and rentals, enabling a proactive and data-informed approach to the ever-evolving real estate landscape.

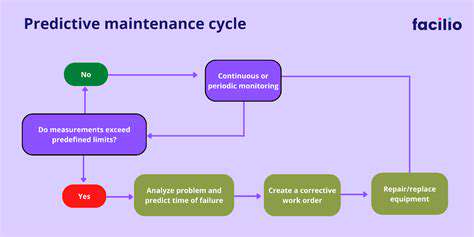

Predictive Maintenance and Property Management

AI can be integrated into property management systems to automate tasks, optimize resource allocation, and predict potential maintenance issues. By analyzing historical data on maintenance requests and property conditions, AI algorithms can identify patterns and proactively schedule maintenance tasks, minimizing downtime and maximizing property value. This proactive approach also helps prevent costly repairs by catching potential problems early on. This predictive maintenance feature is crucial for optimizing property management and minimizing unforeseen expenses.

Personalized Customer Experiences

AI-powered chatbots and virtual assistants can enhance customer interactions by providing instant support and personalized recommendations. This personalized approach allows for a more efficient and effective communication system, which leads to improved customer satisfaction and loyalty. Real estate professionals can use AI to provide tailored information about properties and services, increasing the likelihood of successful transactions.

By understanding the specific needs and preferences of potential buyers and sellers, AI can offer highly targeted recommendations, leading to a more streamlined and personalized experience for all parties involved in a real estate transaction. This personalized approach will ultimately improve the overall experience of the customer.

Optimizing Pricing Strategies

AI algorithms can analyze various factors, including comparable sales, market conditions, and property features, to determine optimal pricing strategies. This data-driven approach ensures that properties are priced competitively, maximizing their appeal to potential buyers and sellers, and ultimately leading to more successful transactions. This accurate pricing strategy allows for efficient use of resources and helps to avoid losing potential profit due to incorrect pricing.

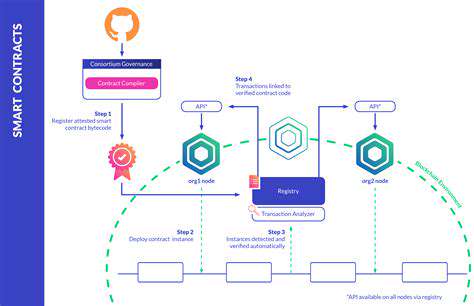

Streamlining Transaction Processes

AI can automate various aspects of real estate transactions, from document processing to contract review, significantly reducing the time and effort required for closing deals. This automation frees up valuable time for agents to focus on building relationships and providing exceptional customer service. Using AI to streamline these processes leads to a more efficient and effective transaction process for all parties involved. The efficiency gains translate to a more profitable and less stressful experience for everyone.

Enhancing Security and Fraud Detection

AI systems can be used to detect fraudulent activities and enhance security measures within the real estate industry. By analyzing vast amounts of data, AI can identify suspicious patterns and flag potential risks, helping to protect both buyers and sellers from fraudulent activities. This level of security is critical in protecting investors and clients from potential financial loss or other harm. Improved security measures build trust and confidence in the real estate market.

Read more about AI in Real Estate: Optimizing Property Valuations for Smarter Investment Decisions and Outcomes

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing