The Financial Risks of Climate Change for Real Estate Professionals and Investment Portfolios

The Emerging Threat to Real Estate Investment Value

The Global Economic Landscape

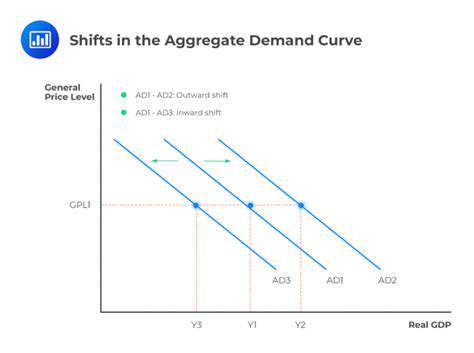

Today's economic environment presents a challenging puzzle for real estate investors. The combination of inflationary pressures, unpredictable interest rate movements, and geopolitical tensions creates a perfect storm of uncertainty. What makes this particularly concerning is how regional economic shocks can propagate globally, forcing investors to constantly reevaluate their positions. Unlike previous decades, today's markets react almost instantaneously to international developments.

Economic analysts observe troubling indicators suggesting we may be approaching a significant downturn. This apprehension manifests in the real estate sector through delayed purchase decisions and extended listing periods. The resulting slowdown could potentially depress property valuations across multiple markets, particularly in regions with overheated pricing.

Interest Rate Fluctuations

Mortgage rates serve as the financial heartbeat of real estate markets, directly influencing buyer behavior and investment returns. When central banks hike rates, the immediate effect appears in higher monthly payments that price many buyers out of the market. This dynamic creates a ripple effect that can stall transactions throughout the property ecosystem.

Existing homeowners face their own set of challenges when rates fluctuate unpredictably. Those with adjustable-rate mortgages may suddenly find themselves paying hundreds more each month, straining household budgets. For investors, this volatility complicates long-term planning and makes accurate yield projections nearly impossible.

The Role of Technology

Digital transformation continues revolutionizing property markets at an unprecedented pace. Virtual tours and AI-powered valuation tools now complement traditional listing services, creating a more dynamic marketplace. While these innovations increase transparency, they also demand that industry professionals develop entirely new skill sets to remain competitive.

However, the technological shift introduces complex ethical considerations. Data privacy concerns emerge as algorithms process sensitive financial information, while the digital divide may exclude certain demographics from equal market participation. These challenges require thoughtful solutions to ensure equitable access to housing opportunities.

Supply and Demand Dynamics

The fundamental economics of real estate hinge on the delicate balance between available inventory and buyer interest. Shifting demographics, employment trends, and lifestyle preferences all contribute to demand fluctuations that vary dramatically by location. Savvy investors monitor these indicators closely when evaluating potential acquisitions.

Localized factors often outweigh national trends in determining property values. Municipal zoning decisions, infrastructure projects, and even school district boundaries can create hyper-localized booms or declines that defy broader market movements. This granularity underscores the importance of thorough due diligence.

Property Damage and Insurance Costs

Understanding Property Damage

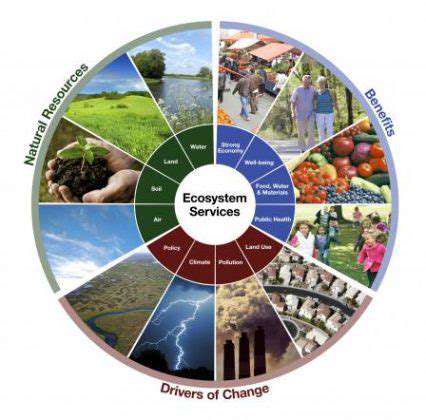

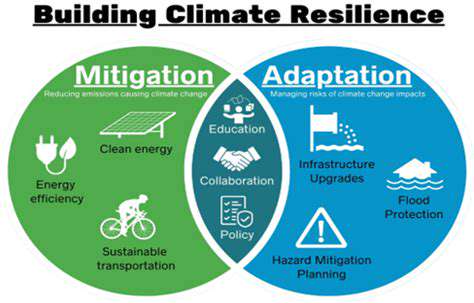

Climate-related property damage now encompasses an alarming array of destructive scenarios. From basement flooding to catastrophic structural failures, the scale and frequency of weather-related incidents continue escalating. Coastal communities face existential threats from rising sea levels, while wildfire zones experience increasingly destructive fire seasons that test the limits of building codes and emergency response systems.

The financial toll of these events often exceeds standard insurance coverage limits, leaving property owners with staggering out-of-pocket expenses. Even after receiving payouts, many find their claims don't account for recent construction cost increases or the full scope of necessary repairs.

Insurance Coverage and Limitations

Standard insurance policies frequently contain exclusions that leave homeowners vulnerable to precisely the climate risks they most fear. Many standard policies omit coverage for flood damage altogether, while others limit payouts for wildfire-related claims. These gaps in coverage become particularly problematic as extreme weather events become more common and severe.

Policyholders should conduct annual coverage reviews with their insurance providers, specifically addressing climate-related perils. Many discover too late that their protection falls short when disaster strikes, leading to financial hardship during already stressful situations.

The Cost of Repair and Replacement

Rebuilding costs have surged due to material shortages, labor constraints, and supply chain disruptions. What might have been a straightforward repair five years ago now requires navigating contractor waitlists and paying premium prices for basic materials. These inflationary pressures create significant gaps between insurance settlements and actual reconstruction expenses.

The complexity multiplies when dealing with historic properties or homes built to modern green standards. Specialized materials and certified contractors command higher prices, while building code updates may require upgrades that weren't part of the original structure.

Long-Term Financial Impacts

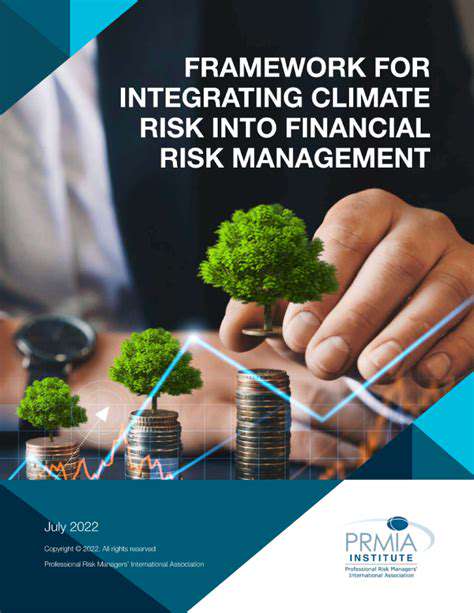

Beyond immediate repair bills, climate damage creates lasting financial consequences. Insurers increasingly designate high-risk areas as uninsurable, triggering mortgage defaults and community abandonment. Property values in vulnerable locations face downward pressure as buyers factor in climate risks, sometimes creating entire neighborhoods of stranded assets.

Forward-thinking investors now incorporate climate resilience into their valuation models, recognizing that today's desirable locations might become tomorrow's liabilities. This paradigm shift is reshaping investment strategies across the real estate sector.

Shifting Market Dynamics and Reduced Demand

Shifting Consumer Preferences

Modern homebuyers prioritize vastly different features than previous generations. The pandemic accelerated demand for home offices and outdoor spaces, while sustainability concerns drive interest in energy-efficient systems. These evolving preferences force developers to rethink traditional floor plans and community designs. Builders who fail to adapt risk being stuck with obsolete inventory as buyer expectations continue evolving.

The digitalization of home shopping has fundamentally altered purchase behaviors. Buyers now complete most research online before ever visiting a property, making high-quality virtual presentations essential. This shift gives tech-savvy agents and developers a significant advantage in today's competitive markets.

Emerging Technologies and their Impact

PropTech innovations are disrupting every aspect of real estate transactions. Blockchain-based contracts, AI-powered valuation tools, and virtual staging technologies are just the beginning of this transformation. Traditional brokerage models face existential threats from these advancements unless they adapt quickly.

Smart home technologies have moved from luxury features to expected standards, with buyers demanding integrated systems that enhance security, efficiency, and convenience. This technological arms race increases development costs while creating new revenue streams for innovative providers.

Economic Fluctuations and their Effects

Recession fears and inflationary pressures create hesitation throughout the real estate ecosystem. Buyers delay purchases hoping for better conditions, while sellers hesitate to list fearing they've missed the market peak. This standoff creates market stagnation that can persist until clear economic signals emerge.

Commercial real estate faces particular challenges as remote work reduces office demand and e-commerce transforms retail space requirements. These structural changes may permanently alter urban landscapes and investment strategies.

Competitive Landscape and Strategies

The real estate industry's competitive dynamics intensify as new digital-first players challenge traditional firms. Brokerages must now compete with iBuyers, online platforms, and hybrid models that offer lower fees and greater convenience. Differentiation through specialized expertise or superior service becomes critical for survival.

Regulatory Changes and Compliance

Evolving regulations present both challenges and opportunities. Stricter energy efficiency standards may increase construction costs but create value for green-certified properties. Zoning reforms in some cities allow higher density development, creating new investment possibilities while potentially oversaturating certain markets.

Tax policy changes, particularly regarding capital gains and depreciation, can significantly impact investment returns. Staying informed about legislative developments helps investors make timely adjustments to their strategies.

Global Market Expansion and Challenges

Cross-border real estate investment brings unique complexities. Currency fluctuations, foreign ownership restrictions, and unfamiliar legal systems create hurdles for international buyers. Successful global investing requires deep local knowledge and reliable partnerships in target markets.

Cultural differences in property expectations and transaction processes often surprise inexperienced international investors. What constitutes a luxury feature in one market might be standard in another, while negotiation styles and contract terms vary dramatically across borders.

Read more about The Financial Risks of Climate Change for Real Estate Professionals and Investment Portfolios

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing