Real Estate Climate Risk: Understanding the Regulatory Framework and Compliance

Climate Risk Assessment and Mitigation Strategies

Understanding the Scope of Climate Risk

Climate risk in property involves diverse potential impacts from extreme weather to long-term climate shifts. This includes immediate threats from hurricanes, floods, and wildfires, plus gradual dangers like sea level rise, increasing droughts, and temperature changes that can weaken buildings over time. Recognizing the full range of potential risks is vital for property owners and investors, as it directly influences real estate value, usability, and long-term sustainability.

Physical Climate Risks

Physical climate risks involve direct consequences of climate change. These encompass greater flood risks from intense rainfall, coastal property threats from rising seas, and growing wildfire dangers, particularly in dry regions. Proper risk evaluation requires detailed analysis of historical climate data, future projections, and location-specific vulnerabilities.

Assessing the likelihood and severity of these events is crucial for informed property decisions regarding acquisition, development, and management. This often involves sophisticated modeling to predict future climate conditions and their local impacts.

Financial and Economic Climate Risks

Beyond physical damage, climate change brings significant financial and economic risks. Examples include declining property values in flood zones, higher insurance costs for high-risk properties, and supply chain disruptions affecting construction. The long-term economic consequences of climate-related damage and disruption substantially influence real estate investment choices and merit careful consideration.

Vulnerability Assessments and Risk Mitigation

Identifying vulnerable properties and developing effective protection strategies is essential. Comprehensive vulnerability assessments examine factors like building materials, design, location, and hazard proximity. Protective measures range from elevating flood-prone structures to using fire-resistant materials in high-risk areas. These assessments and strategies should be customized to each property's specific characteristics and unique climate risks.

Adaptation Strategies for Real Estate

Adaptation measures are crucial for reducing climate change impacts on property. These might include climate-resilient design features for new buildings, upgrades to withstand extreme weather, early warning systems, and investments in green infrastructure like rainwater collection. Implementing these strategies enhances property and community resilience to climate effects.

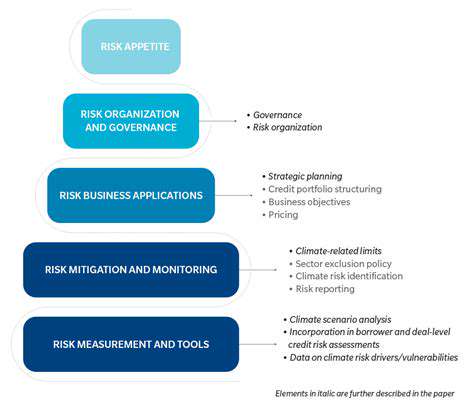

Policy and Regulatory Frameworks

Government policies significantly influence property development and management amid climate change. Regulations concerning building codes, zoning, and environmental impact assessments greatly affect real estate resilience. Understanding and engaging with these policies helps property owners and developers effectively address climate risks and contribute to a more sustainable real estate sector. Supporting strong climate policies at all government levels is essential for effective risk reduction.

Financial Reporting and Disclosure Obligations

Understanding the Scope of Reporting

Financial reporting and disclosure requirements regarding climate risk in real estate are growing more complex and important. Real estate companies must now consider climate change's potential financial impacts, including sea level rise, extreme weather, and environmentally driven market shifts. This means understanding both direct property risks and indirect risks from regulatory changes, shifting investor preferences, and potential reputation damage.

Reporting requirements vary by company size, location, and property type. Staying current with evolving standards and regulations ensures compliance and avoids penalties. This includes monitoring changes in accounting standards, industry practices, and government climate disclosure guidelines.

Navigating the Regulatory Landscape

Managing the complex regulatory environment around climate risk financial reporting presents significant challenges. Investors, lenders, and policymakers increasingly demand transparency about climate-related risks and opportunities. Understanding and complying with these evolving frameworks is crucial for maintaining credibility and protecting reputation.

This involves tracking relevant regulations at national and local levels. Some areas have specific requirements for disclosing climate risks in property valuations, loan applications, or sustainability reports. Non-compliance can lead to substantial fines and legal consequences.

Implementing Effective Disclosure Strategies

Developing strong disclosure strategies for real estate climate risks is essential for transparency and stakeholder trust. This goes beyond meeting regulatory requirements to proactively communicate the company's approach to managing climate-related risks and opportunities.

This includes detailing property vulnerabilities, protective measures, and potential financial impacts. It also requires robust internal processes for climate risk assessment, sustainability targets, and progress reporting. Accurate, transparent reporting attracts responsible investors and demonstrates commitment to long-term value while minimizing climate risks.

Companies should integrate climate risk considerations into overall strategy, including financial planning, investments, and operations. Proactively addressing these issues positions companies for long-term success in an evolving real estate market.

Read more about Real Estate Climate Risk: Understanding the Regulatory Framework and Compliance

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing