Climate Risk and Real Estate Finance: Emerging Trends

Integrating Climate Risk into Lending Practices

Understanding the Scope of Climate Risk

Lending institutions face growing exposure to environmental volatility. The increasing unpredictability of weather patterns and ecological systems directly affects borrowers' financial stability. This new reality demands that credit analysis incorporate sophisticated environmental risk assessment methodologies.

Comprehensive environmental due diligence now involves analyzing historical climate trends, modeling future scenarios, and evaluating how different sectors might be affected. These assessments enable lenders to make more nuanced credit decisions and develop targeted risk management strategies.

Assessing Physical Climate Risks

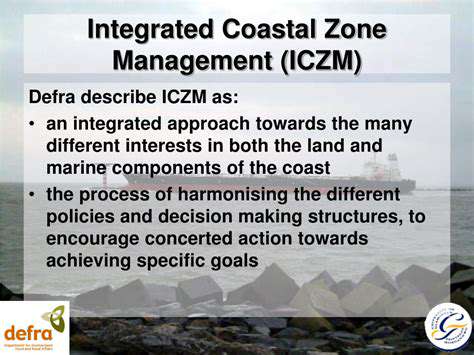

Tangible environmental threats—from severe storms to rising sea levels—require careful evaluation in credit decisions. Lenders must develop robust frameworks for assessing how these factors might impact collateral values and borrower cash flows. This involves detailed analysis of property locations, infrastructure resilience, and potential supply chain vulnerabilities.

Advanced environmental due diligence includes forward-looking assessments that account for projected climate changes. These evaluations help identify properties that may require additional protection measures or face declining values due to environmental factors.

Evaluating Transition Climate Risks

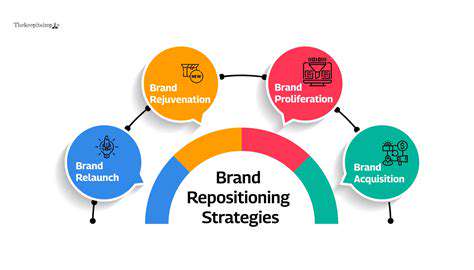

The global shift toward sustainability creates complex challenges for traditional industries. Policy changes, technological breakthroughs, and evolving consumer preferences are reshaping entire sectors. Lenders must evaluate how borrowers are preparing for these transformations, particularly in carbon-intensive industries facing fundamental restructuring.

Credit analysis now includes assessment of corporate sustainability strategies, carbon footprint reduction plans, and adaptability to emerging green technologies. These factors provide critical insights into long-term creditworthiness in a changing economic landscape.

Integrating Climate Data into Lending Processes

Modern credit risk management requires systematic incorporation of environmental analytics. Leading institutions are modifying their credit evaluation frameworks to explicitly account for environmental risk factors. This integration enables more comprehensive assessment of borrower resilience and long-term viability.

Implementing specialized environmental risk assessment tools allows lenders to quantify exposure across different loan portfolios. These tools facilitate scenario analysis and stress testing under various environmental conditions, supporting more informed credit decisions.

Developing Climate-Resilient Lending Strategies

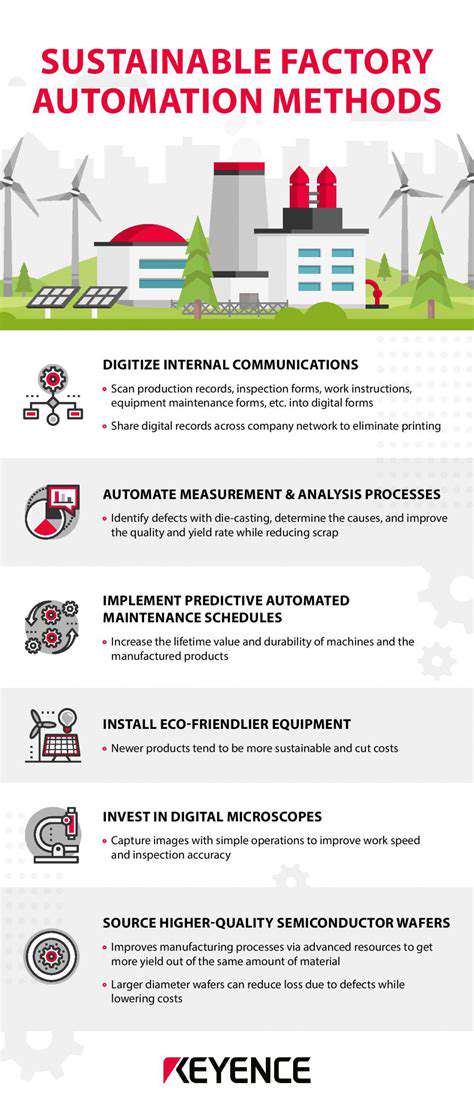

Forward-looking lenders are creating specialized products that support environmental adaptation while managing risk. Innovative financing structures, such as sustainability-linked loans, align borrower incentives with environmental performance targets. These instruments help direct capital toward projects that enhance ecological resilience.

Strategic initiatives may include technical assistance programs that help borrowers implement environmental adaptation measures. By supporting clients through transition periods, lenders can reduce portfolio risk while contributing to broader sustainability goals.

Promoting Transparency and Disclosure

Clear communication about environmental risk management builds market confidence. Lenders who demonstrate rigorous environmental due diligence processes and clear reporting standards gain competitive advantages. Transparent disclosure helps stakeholders understand how institutions are addressing emerging environmental challenges.

Engagement with all stakeholders—from regulators to community groups—strengthens the financial sector's capacity to respond to environmental challenges. Regular reporting on environmental risk management practices demonstrates commitment to responsible lending while providing valuable insights for market participants.

The Role of Policy and Regulation in Shaping the Future

Policy Frameworks for Climate Resilience in Real Estate

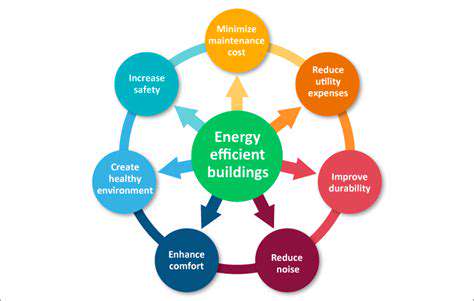

Effective environmental policies must balance economic development with long-term sustainability. Incentive structures that reward green construction techniques and energy-efficient designs have proven particularly effective. Equally important are zoning regulations that prevent development in environmentally sensitive areas while promoting resilient urban planning. These policy tools must evolve alongside scientific understanding to remain effective against emerging environmental threats.

Investment in climate-adaptive infrastructure—from flood control systems to heat-resistant materials—represents a critical policy priority. Such investments not only protect existing assets but also enable sustainable community development. Policymakers must ensure these initiatives address socioeconomic disparities, preventing environmental policies from exacerbating existing inequalities.

Regulatory Approaches to Address Climate Change Impacts

Well-designed regulations can drive innovation in sustainable development practices. Standards for building materials, energy efficiency, and land use create clear expectations while allowing flexibility for technological advancement. These regulatory frameworks must be sufficiently robust to achieve environmental objectives while remaining adaptable to new scientific insights and technological developments.

Mandatory environmental disclosure requirements enhance market transparency, allowing investors to properly assess risk. Standardized reporting frameworks enable meaningful comparison across properties and portfolios, facilitating more efficient capital allocation toward resilient assets.

International Cooperation and Global Standards

Environmental challenges transcend national borders, requiring coordinated policy responses. International collaboration facilitates knowledge sharing and helps align regulatory approaches across jurisdictions. Harmonized standards for environmental risk assessment and reporting create consistency for multinational investors while raising global sustainability benchmarks.

Multilateral agreements provide frameworks for collective action on environmental issues affecting real estate markets worldwide. These agreements can accelerate the adoption of best practices and support capacity building in developing markets. International coordination also helps prevent regulatory arbitrage while promoting equitable solutions to shared environmental challenges.

Global standards organizations play a vital role in developing consistent methodologies for environmental risk analysis. These standards enable cross-border investment by providing common metrics for evaluating sustainability performance. Such harmonization is particularly valuable for institutional investors with international portfolios.

By establishing universal benchmarks for environmental resilience, the global community can more effectively direct investment toward sustainable development. These standards help create transparent markets where environmental performance is properly valued and rewarded.

The development of internationally recognized sustainability certifications provides clear signals to market participants. These certifications help identify properties and projects that meet rigorous environmental standards, facilitating more informed investment decisions across borders.

Read more about Climate Risk and Real Estate Finance: Emerging Trends

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing