AI Powered Valuation: Optimizing Real Estate Investment Decisions and Strategies

While AI valuation tools demonstrate remarkable potential, they function most effectively in partnership with human expertise. The optimal valuation approach combines AI-generated analytics with professional appraisers' contextual understanding and qualitative assessment skills. This collaborative model ensures that data-driven insights receive appropriate interpretation within specific market conditions and property contexts.

The most promising future for real estate valuation lies in this harmonious integration of technological capability and human judgment. Together, these elements can achieve unprecedented levels of accuracy, efficiency, and transparency in property assessment. This combined approach fosters greater confidence among all market participants and elevates the overall quality of real estate investment decision-making.

Data-Driven Property Evaluation Strategies

Advanced Analytics for Accurate Assessments

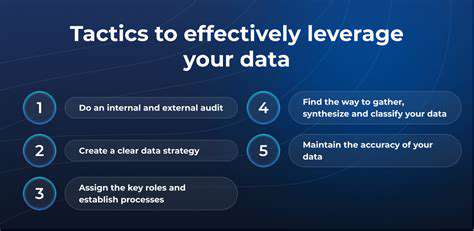

Contemporary property evaluation increasingly relies on sophisticated data analysis techniques. Organizations harnessing comprehensive datasets gain critical understanding of buyer preferences, market conditions, and operational performance. These insights enable development of targeted approaches and process optimization, driving measurable improvements in outcomes and profitability. In today's competitive environment, evidence-based decision making has transitioned from advantageous to essential.

Proper interpretation of data patterns facilitates nuanced problem-solving methodologies. This analytical approach stimulates innovation and adaptability, enabling businesses to anticipate market shifts and maintain competitive advantage.

Strategic Customer Segmentation Techniques

Data analytics enables precise identification and targeting of specific consumer segments. By analyzing behavioral patterns and demographic characteristics, real estate professionals can customize marketing initiatives and property presentations to resonate with distinct buyer groups. This focused strategy enhances marketing efficiency and optimizes resource allocation.

Effective segmentation ensures marketing expenditures generate maximum impact by concentrating on the most promising prospect categories. This targeted methodology yields superior campaign performance and measurable return on investment.

Operational Optimization Through Data

Data analysis serves as a critical tool for enhancing operational effectiveness. By pinpointing process inefficiencies and workflow obstacles, organizations can implement focused improvements. This analytical approach often results in reduced expenses, enhanced productivity, and improved financial performance. Continuous monitoring of key performance metrics remains fundamental to sustained operational excellence.

Data-driven process analysis facilitates streamlined workflows, minimizes resource waste, and maximizes output efficiency. Proactive identification of potential issues through data monitoring enables preventative corrective actions.

Predictive Analytics for Market Forecasting

Advanced forecasting techniques enable anticipation of future market developments. Historical data analysis reveals patterns that predict consumer demand shifts, price fluctuations, and potential risk factors. This forward-looking perspective supports optimized resource deployment, improved strategic decisions, and more resilient business planning.

Visual Data Interpretation for Decision Making

Effective data visualization plays a pivotal role in property analysis. Graphical representations transform complex information into accessible formats, simplifying pattern recognition and trend identification. Well-designed visual presentations enable executives to rapidly assimilate key information and make informed choices. This streamlined analytical process accelerates decision-making and enhances organizational performance.

Visual data analysis facilitates quick identification of critical areas requiring attention, supporting strategic planning based on empirical evidence. This approach fosters an organizational culture grounded in data-driven decision processes, ultimately improving operational effectiveness and goal attainment.

Market Prediction Through Advanced Modeling

Foundations of Predictive Analytics

Modern valuation methodologies increasingly incorporate predictive modeling techniques that analyze historical trends and complex algorithms to forecast market movements. This analytical process examines economic indicators, consumer patterns, and industry developments to identify relationships that predict future conditions. The reliability of these forecasts depends on data quality and modeling sophistication.

Various modeling approaches—including temporal analysis, machine learning systems, and econometric models—offer distinct advantages depending on specific market characteristics and accuracy requirements. Continuous model refinement through new data integration ensures ongoing predictive relevance.

Predictive Modeling in Contemporary Valuation

In AI-enhanced valuation systems, predictive modeling provides critical insights into asset valuation. By projecting future income streams and market scenarios, these algorithms deliver more comprehensive assessments than traditional methods. This forward-looking capability proves particularly valuable in volatile markets where conventional techniques may prove inadequate.

Adaptive modeling enables responsive valuation processes that adjust to market fluctuations. This flexibility proves essential for optimizing investment approaches and risk management strategies. The technique can reveal market irregularities and emerging trends that might otherwise remain undetected.

Sophisticated data analysis identifies complex relationships and potential market opportunities. This pattern recognition capability provides critical advantages in navigating contemporary market complexities.

The integration of predictive modeling with AI valuation systems creates powerful analytical tools for asset assessment. This combination enhances decision-making across financial operations, from investment planning to risk evaluation.

Market forecasting capability provides strategic advantages in complex financial environments, enabling optimized investment decisions and improved financial outcomes.

When considering electric vehicle purchases, careful review of battery warranty provisions becomes essential. These contractual agreements often present significant variations in coverage duration, included protections, and limitation clauses. Thorough examination of warranty documentation represents the only reliable method to ensure informed purchasing decisions. Overlooking critical warranty terms may lead to unforeseen financial obligations when maintenance requirements arise.