Transitional Climate Risk: Implications for Real Estate

Policy and Regulatory Frameworks

Policy and regulatory frameworks play a crucial role in shaping the business environment, impacting everything from investment decisions to market competition. Understanding the nuances of these frameworks is essential for businesses operating within a given jurisdiction. These frameworks often dictate permissible activities and impose limitations on certain practices, which can significantly affect profitability and operational efficiency. Navigating these complex landscapes requires a deep understanding of the specific laws and regulations, as well as the potential for future changes.

The constant evolution of regulations necessitates continuous monitoring and adaptation. Businesses must proactively assess potential impacts and adjust strategies accordingly. Failure to adapt to evolving regulations can lead to costly penalties and reputational damage.

Impact on Market Dynamics

Regulatory shifts can dramatically alter market dynamics. New policies can introduce barriers to entry for some businesses, while others may find opportunities to capitalize on the changes. For example, new environmental regulations might incentivize investments in sustainable technologies, creating new markets and opportunities for innovation.

The potential for disruption is substantial, requiring businesses to re-evaluate their competitive strategies and identify potential vulnerabilities. Regulatory changes can also influence consumer behavior, impacting demand and supply chains in unforeseen ways.

Financial Implications

Regulatory shifts often have significant financial implications for businesses. Compliance costs associated with adhering to new regulations can be substantial, particularly for larger organizations. These costs can affect profitability and impact the overall financial health of the business.

Changes in tax laws, for instance, can dramatically influence the financial structure of a business, impacting both investment decisions and the overall financial performance. Businesses must carefully assess the financial impact of potential regulatory changes and develop mitigation strategies.

Operational Adjustments

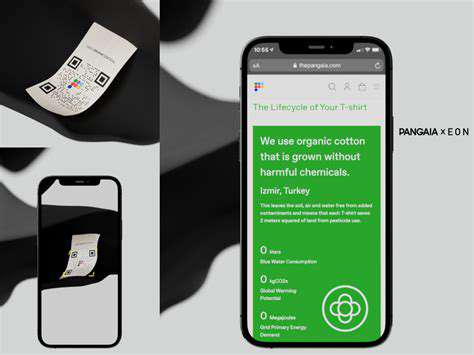

Navigating policy and regulatory shifts necessitates operational adjustments. Businesses may need to modify internal processes, implement new technologies, or retrain staff to comply with new requirements. For instance, data privacy regulations might require significant changes to data management and security protocols.

These adjustments can be costly and time-consuming, demanding careful planning and resource allocation. Successful implementation requires clear communication and collaboration across different departments within the organization.

Innovation and Adaptation

In many cases, regulatory shifts can spur innovation. Businesses seeking to adapt to new regulations often explore innovative solutions and technologies that enhance efficiency and compliance. For example, the emergence of new environmental regulations might encourage the development of cleaner energy sources.

The ability to adapt and innovate in response to regulatory changes becomes a key differentiator in the marketplace. Companies that can effectively anticipate and adapt to shifting policies will likely enjoy a competitive advantage.

Consumer Impact

Regulatory shifts frequently impact consumers in various ways. New regulations on product safety, for example, can enhance consumer confidence and safety. However, new regulations can also lead to higher prices for consumers, especially when compliance costs are passed on to the end-user.

Changes in regulations regarding labeling, pricing, or product availability can significantly affect consumer choices and preferences. Understanding the potential consumer impact of regulatory changes is essential for businesses to effectively anticipate and manage potential risks.

Automated travel systems are rapidly transforming the entire landscape of the global travel industry, impacting everything from booking and transportation to customer service and even destination experiences. This automation presents a complex interplay of challenges and opportunities, requiring a nuanced understanding of how technology can both streamline processes and enhance the overall travel experience. From streamlining booking procedures to automating airport check-in, the integration of technology promises significant efficiency gains, but this also necessitates a careful consideration of the human element and the potential for disruption.

Physical Impacts of Climate Change and Their Implications for Real Estate

Rising Temperatures

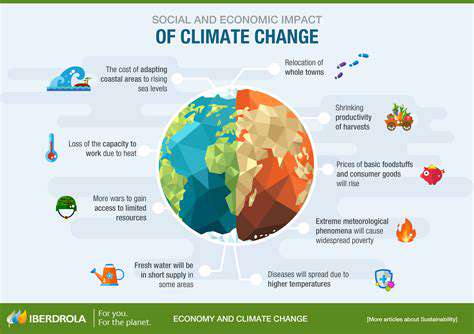

Global temperatures are increasing at an alarming rate, driven primarily by the release of greenhouse gases into the atmosphere. This warming trend is already impacting various ecosystems and human societies. Rising temperatures lead to more frequent and intense heatwaves, posing a serious threat to human health, especially for vulnerable populations. The consequences are far-reaching, affecting agricultural yields, water resources, and overall biodiversity.

The effects of rising temperatures extend beyond immediate discomfort. Prolonged heatwaves can trigger severe health complications, including heatstroke and dehydration, and exacerbate existing health conditions. This has significant implications for public health systems, requiring greater investment in preparedness and response measures.

Changing Precipitation Patterns

Climate change is disrupting established precipitation patterns, leading to more erratic and extreme weather events. This includes an increase in both droughts and floods in different regions around the globe. This unpredictability poses significant challenges for agriculture and water management, impacting food security and livelihoods. The variability of rainfall patterns has a cascading effect on ecosystems, affecting plant and animal life, and altering the delicate balance of natural habitats.

Sea Level Rise

The melting of glaciers and ice sheets, coupled with the thermal expansion of water, is causing a significant rise in sea levels. This poses a major threat to coastal communities and infrastructure, potentially displacing millions of people and leading to the inundation of low-lying areas. Coastal erosion and saltwater intrusion into freshwater sources are additional concerns exacerbated by sea level rise, highlighting the urgency of mitigation and adaptation strategies. The long-term consequences of sea level rise are substantial, requiring significant investments in coastal protection and relocation.

Extreme Weather Events

Climate change is intensifying extreme weather events, including hurricanes, cyclones, floods, and droughts. These events cause widespread damage to property, infrastructure, and agricultural lands, leading to economic losses and displacement. The frequency and intensity of these events are increasing, highlighting the need for robust disaster preparedness and response mechanisms. Communities must adapt to the changing weather patterns and develop more resilient infrastructure to withstand the impacts of extreme weather.

Impacts on Ecosystems

Climate change is disrupting ecosystems worldwide, altering habitats and impacting biodiversity. Changes in temperature and precipitation patterns are forcing species to migrate, adapt, or face extinction. Coral reefs, for example, are experiencing bleaching events due to rising ocean temperatures, threatening the delicate balance of marine ecosystems. The loss of biodiversity has significant implications for the provision of essential ecosystem services, such as pollination and water purification.

Impacts on Human Health

Climate change is having a profound impact on human health, increasing the risk of heatstroke, respiratory illnesses, and infectious diseases. Warmer temperatures can also contribute to the spread of disease vectors like mosquitoes, carrying diseases like malaria and dengue fever. Changes in air quality and the increased frequency of extreme weather events further exacerbate these risks. Protecting human health in the face of climate change requires comprehensive strategies that address both mitigation and adaptation.

Adapting to the Future: Strategies for Real Estate Investment

Navigating the Changing Climate Landscape

Real estate investment strategies must adapt to the evolving climate landscape. This means considering the potential impacts of rising sea levels, more frequent and intense storms, and changing temperature patterns. Investors need to understand how these factors might affect property values, rental income, and the overall viability of a given investment. Proactive assessments of flood risk, drought vulnerability, and infrastructure resilience are crucial for making informed decisions.

Thorough due diligence is essential. Understanding the historical climate data of a location, projected future changes, and the potential for natural disasters is critical. This includes researching local zoning regulations, building codes, and environmental impact assessments to anticipate future restrictions and regulations.

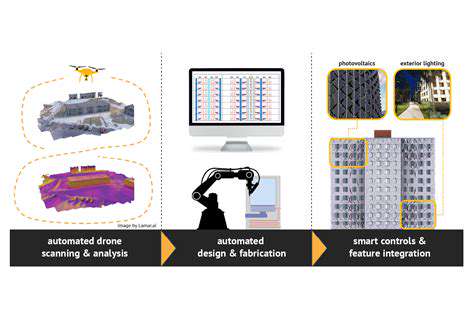

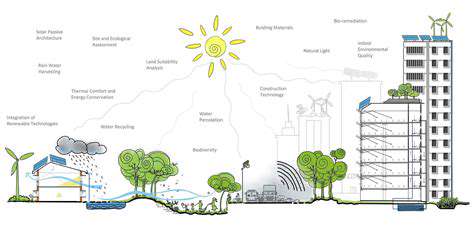

Investing in Sustainable Practices

Sustainability is no longer a niche concern; it's a fundamental aspect of responsible real estate investment. Integrating eco-friendly features, such as energy-efficient appliances, solar panels, and green building materials, can significantly improve the value and appeal of properties. This approach not only reduces environmental impact but also attracts environmentally conscious tenants and buyers, potentially increasing long-term returns.

Implementing energy-efficient technologies and practices in existing properties can yield substantial savings in utility costs for tenants and owners, while also improving the property's overall appeal to a growing segment of the market that values sustainability. This demonstrates a commitment to a more environmentally conscious future.

Adapting to Shifting Demographics

Understanding and responding to changing demographic trends is crucial for real estate investment success. As populations shift, so do the needs and preferences of potential tenants and buyers. Analyzing migration patterns, family structures, and economic factors allows investors to target properties strategically and maximize returns.

Evaluating Infrastructure Resilience

Examining the resilience of local infrastructure is vital in a transitional climate. Assessing the vulnerability of roads, bridges, water systems, and other critical infrastructure to climate-related events is essential for predicting potential disruptions and their impact on property values and rental income. Investments in infrastructure improvements can enhance the long-term value and sustainability of properties.

Anticipating the need for infrastructure upgrades and resilience measures, such as flood defenses or drought-resistant landscaping, is a key element of assessing future viability. This proactive approach allows investors to mitigate risk and position themselves for success in a dynamic market.

Exploring Alternative Investment Vehicles

Transitional climate conditions may necessitate exploring alternative investment vehicles that offer greater resilience and sustainability. This could include investments in renewable energy projects, green building technologies, or real estate funds focused on sustainable development. These alternatives may provide higher returns and a more sustainable long-term investment strategy.

Diversifying Portfolios for Enhanced Risk Mitigation

Diversifying real estate portfolios across various geographic locations and property types can help mitigate the risks associated with climate change. Investing in properties in regions less susceptible to extreme weather events, or diversifying into different property types (e.g., multi-family vs. single-family), can help cushion against potential losses in specific areas. This strategy is crucial for long-term success in a constantly evolving market.

A diversified portfolio can help to reduce the overall risk associated with climate-related events. This strategy provides a more balanced approach to real estate investment, ensuring greater stability and potential for long-term growth in a transitional climate.

Read more about Transitional Climate Risk: Implications for Real Estate

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing