Climate Change Impacts on Real Estate Finance

Impacts of Rising Water Levels

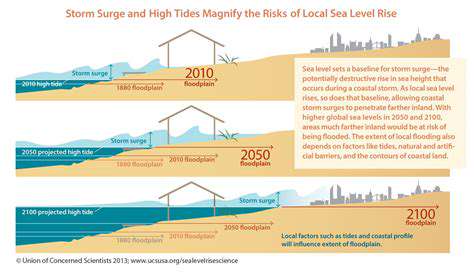

Coastal towns and cities are grappling with growing dangers as ocean waters creep inland, submerging vulnerable zones with greater regularity and intensity. Homes, commercial properties, and critical infrastructure face unprecedented jeopardy, threatening mass displacements and crippling financial impacts. The ripple effects of these inundations extend far beyond property damage, potentially undermining the economic foundations of coastal areas for generations. Forward-thinking protective measures are no longer optional but essential for survival.

Saltwater contamination of freshwater supplies presents another looming crisis, requiring immediate investment in advanced filtration systems and alternative water sources. Meanwhile, the relentless tides continue to eat away at shoreline stability, creating a vicious cycle of erosion that amplifies flood damage year after year.

Protecting Coastal Infrastructure

Critical transportation networks and utility systems along coastlines sit squarely in harm's way. When floodwaters compromise these lifelines, entire regions can grind to a halt, with economic repercussions felt nationwide. Engineers now prioritize innovative defenses—elevated roadways, modular flood walls, and AI-powered warning networks—to keep essential services operational during disasters.

These ambitious projects demand meticulous coordination between multiple stakeholders. Comprehensive risk assessments must guide every decision, with customized solutions developed through close collaboration between government planners, technical experts, and local residents.

Addressing Societal Vulnerability

Marginalized populations bear the brunt of flooding disasters, lacking resources to recover or relocate. Targeted relief programs—including emergency grants, affordable housing initiatives, and community support networks—represent our best hope for protecting these at-risk groups. Without such interventions, existing inequalities will only deepen with each new flood event.

Disaster preparedness takes on special urgency for vulnerable communities. Accessible warning systems, strategically placed shelters, and basic supply stockpiles can mean the difference between survival and catastrophe. Local education initiatives that teach flood readiness skills empower residents to become active participants in their own protection.

Climate Change Adaptation Strategies

The flood crisis cannot be separated from the broader climate emergency. Meaningful solutions must address root causes through aggressive emissions reductions and rapid transition to renewable energy sources. This global challenge requires unprecedented international cooperation to transform our energy systems.

Adaptation planning demands equal innovation—from smarter water management to redesigned urban landscapes. The most effective approaches will blend immediate protective measures with visionary policies that reshape our relationship with coastal environments.

Extreme Weather Events: A Growing Threat to Property Values

Increased Frequency of Extreme Weather Events

A changing climate continues to intensify weather extremes across the globe. Record-breaking heatwaves test infrastructure limits while catastrophic floods rewrite community maps overnight. These escalating disasters underscore the critical need for adaptive planning to soften their human and economic toll.

The financial implications are staggering—insurance payouts skyrocket, reconstruction costs spiral, and entire neighborhoods see their economic foundations eroded along with the physical damage.

Impact on Property Values

Real estate markets increasingly reflect weather risks, with flood-prone areas experiencing notable value declines. Buyer reluctance creates subdued demand in high-risk zones, depressing prices—especially for properties with prior weather-related damage. Future risk perceptions compound the problem, as purchasers factor in potential insurance hikes and rebuilding costs when making offers.

Some markets now see widening price gaps between protected and exposed properties, creating new patterns of housing inequality based on geographic vulnerability.

Insurance Costs and Coverage

Skyrocketing premiums reflect insurers' growing risk exposure, placing heavy burdens on property owners in disaster-prone regions. Coverage availability itself becomes unpredictable, with some carriers withdrawing from high-risk markets entirely. This insurance crisis hits vulnerable communities hardest, where residents often lack resources to absorb these added costs.

Mitigation Strategies and Adaptation

Proactive measures can reduce weather-related losses—from reinforced buildings to redesigned drainage systems. Community-wide resilience planning proves most effective when it combines physical upgrades with robust emergency protocols. Early warning networks and preparedness training help minimize casualties and speed recovery when disasters strike.

Economic Consequences of Extreme Weather

The economic shockwaves extend far beyond direct property damage. Supply chain disruptions ripple through industries, tourism revenues evaporate, and regional economies falter under reconstruction burdens. Governments face difficult choices as disaster recovery competes with other priorities for limited public funds.

The Shifting Landscape of Insurance and Risk Management

The Rise of Digital Insurance Platforms

Technology revolutionizes insurance accessibility, with intuitive digital platforms simplifying everything from policy selection to claims filing. This seismic shift pressures traditional insurers to modernize or risk obsolescence as consumers embrace the convenience of online services. Advanced data analytics enable personalized coverage options, potentially expanding access to previously underserved markets.

The Impact of Technology on Claims Processing

AI-driven automation dramatically accelerates claims resolution, with some systems approving straightforward cases in hours rather than weeks. Policyholders benefit from transparent, real-time updates throughout the claims journey, reducing frustration and uncertainty during stressful situations.

The Importance of Data Security in the Digital Age

As insurers digitize sensitive customer information, cybersecurity becomes non-negotiable. A single breach could destroy consumer trust—the foundation of the insurance relationship. Leading firms invest heavily in encryption, multi-factor authentication, and continuous monitoring to protect policyholder data.

The Future of Insurance Regulation

Regulators race to keep pace with industry innovation while protecting consumers. The delicate balance between fostering progress and preventing abuse will define insurance policy for years to come. New frameworks must ensure digital platforms maintain fairness, transparency, and responsible data practices.

The Role of Artificial Intelligence in Insurance

AI transforms risk assessment, enabling hyper-personalized pricing models that reflect individual circumstances. These sophisticated algorithms can make coverage more affordable for low-risk customers while improving insurer accuracy. Virtual assistants enhance customer service with 24/7 availability, handling routine inquiries to free human agents for complex cases.

The Future of Real Estate Finance in a Changing World

Disruptive Technologies Shaping the Landscape

Financial technology reinvents property transactions through automated underwriting and digital closings. Blockchain introduces unprecedented transparency to title transfers while reducing fraud risks. Beyond lending, AI-powered analytics help investors identify emerging opportunities and optimize portfolio performance.

Challenges and Opportunities for the Future

Technology adoption brings growing pains—from cybersecurity concerns to regulatory uncertainties. Yet the potential rewards justify the effort, as innovative solutions promise to democratize access to real estate investment. The sector must also adapt to demographic shifts and evolving work patterns that redefine housing needs.

Remote work trends spur demand for flexible living spaces, requiring creative financing solutions. Understanding these behavioral changes will separate successful lenders from those left behind in the new real estate landscape.

Read more about Climate Change Impacts on Real Estate Finance

Hot Recommendations

- AI in Property Marketing: Virtual Tours and VR

- Water Management Solutions for Sustainable Real Estate

- IoT Solutions for Smart Building Energy Management

- Sustainable Real Estate: Building a Greener Tomorrow

- Sustainable Real Estate: From Concept to Community

- AI Driven Due Diligence for Large Scale Developments

- Real Estate Sector and Global Climate Agreements

- Smart Buildings: The Key to Smarter Property Management

- Zero Waste Buildings: A Sustainable Real Estate Goal

- Understanding Climate Risk in Real Estate Financing